ctcLink Accounting Manual | 10.40 Combination Edit Rules

10.40 Combination Edit Rules

10.40.10.1 GAAP, GASB, State of Washington and ctcLink

Since the community and technical college system is part of the state of Washington, it must follow Governmental Accounting Standards Board (GASB) guidance for the implementation of Generally Accepted Accounting Principles (GAAP) in state and local governments, state of Washington accounting and budgeting rules and State Board policies.

10.40.10.2 ChartField Combination Editing

Peoplesoft is designed to be used by various enterprise types and numerous countries and therefore has the flexibility to create rules which limit the combination of chartfield values allowed to meet most accounting standards.

Combinations of ChartField values can be edited to determine such things as which accounts are valid with which departments, funds or operating units. ChartField combination editing is used to maintain discipline over accounting entries to eliminate invalid entries.

Rules are either designed to be inclusive or exclusive. Some rules state which combination of values are allowable, and all others are not allowable. Other rules define the specific combinations of values which are not allowed (and therefore all others are allowed).

The combination rules established in ctcLink are designed to ensure the community and technical colleges follow guidance provided as noted above.

In describing the rules, we have attempted to provide a short title describing the rule followed by the rule name in parenthesis that will be displayed in the error message.

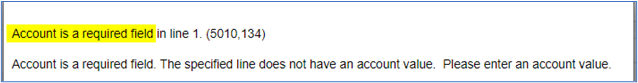

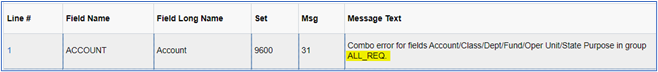

Each rule has an ‘anchor’ or field that triggers the rule. In the Required Fields (ALL_REQ) rule the anchor is the Account field. Therefore, when the anchor field rule is violated, the following error should display immediately:

When one of the non-anchor values of the Required Fields (ALL_REQ) rule is violated the following error message will be displayed:

10.40.20.1 Required Fields (ALL_REQ)

Requires values in the following fields in all transaction lines:

- Account (Anchor)

- Operating Unit

- Fund

- Class

- Department

- State Purpose (IT Costs)

10.40.20.2 Fund-Appropriation Index Combos Required (APPROP1)

Requires Appropriation Index for all Fund Type 1 and Capital Project funds when any account is used.

The allowed fund/appropriation index combinations are updated each fiscal year based on values assigned by the state for the community and technical college system.

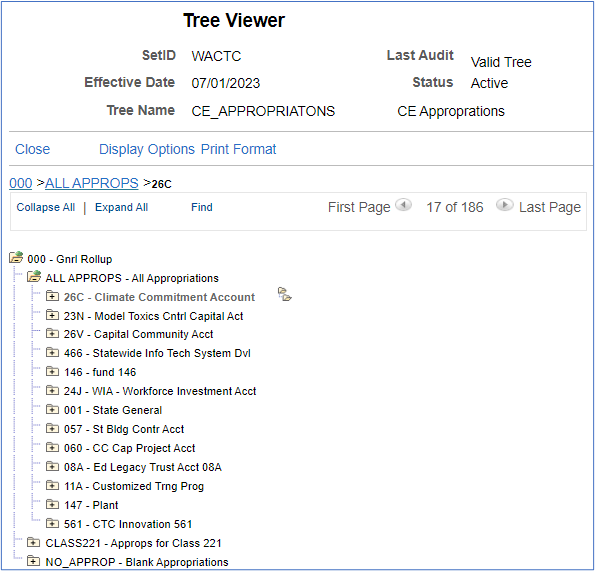

With appropriate permissions, colleges can view the ‘tree’ that controls the combinations allowed (Menu > Tree Manager > Tree Viewer > CE_APPROPRIATIONS) and selecting the current fiscal year.

10.40.20.3 Certain Accounts Allowed By Fund Class (RSTRACC)

This an INCLUSIVE list of allowed use of certain accounts in specific funds. All other uses of these accounts are not permitted. The anchor for this rule is ‘Account’.

This rule has four parts or sequences.

Sequence 1: Accounts Allowed In Fund 148, Class 042:

| Account | Description |

|---|---|

| 4010020 | Sales in Proprietary Funds |

| 5030120 | Net Cost of Goods Sold |

| 5030130 | COGS Purchases |

| 5030140 | COGS Returned Purchases |

| 5030150 | COGS Freight In |

| 5030160 | COGS Freight Out |

| 5030170 | COGS Discounts |

| 5030180 | COGS Inventory Adjustments |

| 5030190 | COGS Direct Labor |

| 5030200 | COGS Raw Materials |

| 5030210 | COGS Manufacturing Overhead |

Sequence 2: Only the following accounts:

| Account | Description |

|---|---|

| 1040010 | Prepaid Expenses |

| 1120003 | Capital Assets |

| 1120004 | Non-Depreciable Capital Assets |

| 1120010 | Land |

| 1120020 | Construction in Progress |

| 1120030 | Intngbl Assets Indef Life |

| 1120040 | Non-Depreciable Collections |

| 1121004 | Depreciable Capital Assets |

| 1121010 | Depreciable Infrastructure |

| 1121020 | Allow for Depr - Infrastructure |

| 1121030 | Buildings |

| 1121040 | Allowance for Depr - Buildings |

| 1121050 | Improvements Other than Bldgs |

| 1121060 | Allow-Depr - Impr Not Bldgs |

| 1121070 | Furnishings and Equipment |

| 1121080 | Allow-Depr - Furn and Equip |

| 1121090 | Library Resources |

| 1121100 | Allow-Depr - Library Resources |

| 1121110 | Intngbl Assets Definite Life |

| 1121120 | Allow-Amortizn-Intngbl Assets |

| 1122003 | Leased Capital Assets |

| 1122010 | Leased Asset - Land |

| 1122020 | Allow for Amort - Leased Land |

| 1122030 | Leased Asset - Buildings |

| 1122040 | Allow for Amort - Leased Building |

| 1122070 | Leased Asset - Furnishings & Equip |

| 1122080 | Allow for Amort - Leased Furnishings & Equip |

| 4010020 | Sales in Proprietary Funds |

| 5030120 | Net Cost of Goods Sold |

| 5030130 | COGS Purchases |

| 5030140 | COGS Returned Purchases |

| 5030150 | COGS Freight In |

| 5030160 | COGS Freight Out |

| 5030170 | COGS Discounts |

| 5030180 | COGS Inventory Adjustments |

| 5030190 | COGS Direct Labor |

| 5030200 | COGS Raw Materials |

| 5030210 | COGS Manufacturing Overhead |

| 5070010 | Prop - Depreciation Exp (Assets) |

| 5070020 | Prop - Amortization Exp (Assets) |

| 5070030 | Amortization Premiums/Discounts |

| 5070060 | Prop - Prior Depreciation |

| 5070065 | Prop - Change in Capitalization |

| 5081270 | Prop - Bad Debt Expense |

Are allowed in these funds:

| Fund | Description |

|---|---|

| 440 | Store |

| 443 | Central Data Processing |

| 444 | Central IT Services |

| 448 | Printing Fund |

| 450 | HE Other Facilities |

| 460 | Motor Pool |

| 522 | Associated Students |

| 524 | Bookstore |

| 528 | Parking |

| 569 | Food Service |

| 570 | Other Auxiliary Ente |

| 573 | Housing & Food |

But not with class 221 (or allowed in all classes except for 221).

Sequence 3: The following accounts are only allowed in Fund 997 with Class 211:

| Fund | Description |

|---|---|

| 1120003 | Capital Assets |

| 1120004 | Non-Depreciable Capital Assets |

| 1120010 | Land |

| 1120020 | Construction in Progress |

| 1120030 | Intngbl Assets Indef Life |

| 1120040 | Non-Depreciable Collections |

| 1121004 | Depreciable Capital Assets |

| 1121010 | Depreciable Infrastructure |

| 1121020 | Allow for Depr - Infrastructure |

| 1121030 | Buildings |

| 1121040 | Allowance for Depr - Buildings |

| 1121050 | Improvements Other than Bldgs |

| 1121060 | Allow-Depr - Impr Not Bldgs |

| 1121070 | Furnishings and Equipment |

| 1121080 | Allow-Depr - Furn and Equip |

| 1121090 | Library Resources |

| 1121100 | Allow-Depr - Library Resources |

| 1121110 | Intngbl Assets Definite Life |

| 1121120 | Allow-Amortizn-Intngbl Assets |

| 5070040 | Govt - Depreciation Expense (997) |

| 5070050 | Govt - Amortization Expense (997) |

| 5070070 | Govt - Capital Asset Adjust (997) |

Sequence 4: These accounts re allowed in all classes except 221

| Account | Description |

|---|---|

| 4000010 | Tuition & Fees |

| 4000020 | Resident Tuition |

| 4000030 | International Tuition |

| 4000040 | Non-Resident Tuition |

| 4000100 | Tuition & Fee Waiver |

| 4000199 | Waiver Error |

Are allowed in these funds:

| Fund | Description |

|---|---|

| 060 | CTC Cap Project |

| 149 | Operating Fees |

| 522 | Associated Students |

| 561 | CTC Innovation |

| 860 | Institutional Financial Aid Fund |

10.40.20.4 Certain Accounts Not Allowed By Fund Class (RSTRACCTS2)

This rule prevents the entry of certain accounts with certain funds. The accounts listed are NOT allowed with these funds. It has two parts or sequences.

Sequence 1 DOES NOT allow these accounts:

| Account | Description |

|---|---|

| 4020020 | Interagency Reimb Salaries |

| 4020030 | Interagency Reimb Benefits |

| 4020040 | Shared Leave Reimb |

| 4020050 | Interagency Reimb Contracts |

| 4020060 | Interagency Reimb Goods/Service |

| 4020070 | Interagency Reimb Travel |

| 4020080 | Interagency Reimb Equipment |

| 4020090 | Interagency Reimb Comp Equip |

| 4020100 | Interagency Reimb Grants |

| 4020110 | Interagency Reimb Debt Svc |

| 5110010 | Debt Service Principal |

| 5110030 | COP Lease/Purchase Principal |

| 5110110 | Equipment Leases - Principal |

| 5110130 | Building Leases - Principal |

In these funds:

| Fund | Description |

|---|---|

| 440 | Stores |

| 443 | Data Processing |

| 444 | Central IT Services |

| 448 | Printing |

| 450 | Other Facilities |

| 460 | Motor Pool |

| 522 | Associated Students |

| 524 | Bookstore |

| 528 | Parking |

| 569 | Food Service |

| 570 | Other Auxiliary Enterprises |

| 573 | Housing & Food |

Sequence 2 DOES NOT allow these accounts:

| Account | Description |

|---|---|

| 4030140 | Interfund Transfer In |

| 4030150 | Interfund Transfer Out |

In these funds:

| Fund | Description |

|---|---|

| 001 | State General |

| 057 | State Building Construction Fund |

| 060 | CC Cap Project Fund |

| 149 | Operating Fees Fund |

| 253 | Education Const Fund |

| 357 | Gardner-Evans Construction Fund |

| 489 | Pension Funding |

| 561 | CTC Innovation |

| 790 | Comm Coll Clearing |

| 840 | Agency |

| 08A | Ed Legacy Trust Fund |

| 11A | Customized Trng Prog |

| 23N | Model Toxics Control Capital |

| 24J | Workforce Educ Investment Fund |

| 26C | Climate Commitment Fund |

| 26V | Capital Community Assistance |

| 997 | Gen Fixed Asset Subsid Acct |

| 999 | Gen L-T Obligation Subsid Acct |

10.40.20.5 System-Wide Fund-Class-Departments (BANK_CASH)

Limits the Fund, Class & Department combinations allowed for the following departments:

| Department | Fund | Class | Purpose |

|---|---|---|---|

| 98019 | 846 | 271 | FA Payable - Recon |

| 98099 | 148 | 285 | Conversion Charges only |

| 790 | 285 | Conversion Charges only | |

| 841 | 285 | Conversion Charges only | |

| 98209 | 790 | 285 | Interunit Default Suspense |

| 841 | 285 | Interunit Default Suspense | |

| 98219 | 145 | 182 | F&A - Indirect |

| 146 | 182 | F&A - Indirect | |

| 98349 | 790 | 285 | AR On Account |

| 841 | 285 | AR On Account | |

| 98489 | 790 | 285 | Bank Cash Pre-Reconciliation |

| 841 | 285 | Bank Cash Pre-Reconciliation |

10.40.30.1 Certain Accounts Allowed in Fund 149 (FND149ACCT)

This combo edit rule limits the accounts allowed in Fund 149. It uses a tree node in the CE_ACCOUNTS tree to define the allowed accounts:

| Account | Account Numbers |

|---|---|

| All Asset Accounts | 1000002 - 1999999 |

| All Liability Accounts | 2000002 - 2999999 |

| All Equity Accounts | 3000002 - 3999999 |

| Specified Revenue Account: | |

| Tuition | 4000010 - 4000120 |

| Waivers | 4000100 – 4000190 |

| Interagency Reimbursements | 4020020 - 4020120 |

| Investment Income | 4030120 & 4120010 |

| Interfund Fund Transfer In | 4030140 |

| Expenditure Accounts | 5000000-5999999 |

10.40.30.2 Accounts Not Allowed in Proprietary Type Funds Rules (INVRULFDAC)

This rule prohibits the use of interagency/Intercollege reimbursement accounts (50813xx accounts) in proprietary type funds.

The following accounts:

| Account | Description |

|---|---|

| 5081310 – 5081395 | Interagency/intercollege reimbursement accounts |

Are not allowed in the following funds:

(limited by the funds listed in the Proprietary Funds node of the Combo Fund Type tree):

| Fund | Description |

|---|---|

| 440 | Central Stores |

| 443 | Central Data Processing |

| 448 | Printing Fund |

| 450 | HE Other Facilities |

| 460 | Motor Pool |

| 522 | Associated Students |

| 524 | Bookstore |

| 528 | Parking |

| 529 | Food Service |

| 570 | Other Auxiliary Enterprises |

| 573 | Student Housing |

10.40.30.3 Fund 149/999 Account Restrictions (FUND_ACCT)

This rule defines which accounts are allowed in Fund 149 and Fund 999.

Sequence 1

This rule uses the Fund 149 node of the CE_ACCOUNTS tree to define allowed accounts. In Fund 149 only the following accounts are permitted:

| Account Type | Account Numbers |

|---|---|

| Asset Accounts | 1000000 through 1200020 |

| Liability Accounts | 2000000 through 2140200 |

| Equity Accounts | 3000000 through 3100230 |

| Revenue Accounts |

4000010 through 4000120 Tuition & Fees 4000190 - CARES Write-Off 4000199 - Waiver Error 4020020 - 4020120 Interagency Reimbursement 4030120 - Interest Revenue 4030140 – Interfund Transfer In 4120010 – Investment Interest |

| Expense Accounts | 5000000 – 5900099 |

Sequence 2

This rule uses the Fund 999 node of the CE_ACCOUNTS tree to define allowed accounts. In Fund 999 only the following accounts are permitted:

Asset Accounts:

Liability Accounts: 2001010 – 2001040 S-T Installment Liabilities

| Account Type | Account Numbers |

|---|---|

| Asset Accounts | 1110030 through 1110040 Debt Service |

| Liability Accounts |

2020010 – 2020030 S-T Leave Liabilities 2050010 – 2050200 S-T Lease Liabilities (inc COPs) 2100010 – 2100030 L-T Leave Liabilities 2130040 – 2130100 L-T Other Liabilities (inc COPs) 2140010 L-T Installment Liabilities 2140100 – 2140200 L-T Lease Liabilities |

10.40.40.1 Local Capital Projects Fund-Appr Index-Class Combo (CLS_FND_AI)

The correct appropriation index must be used when class code 221 is used in the funds listed below. Capital project entries in local funds must use the correct appropriation index when using Class Code 221. This rule also requires Class 221 to be used when a capital appropriation (R1x) used in the listed local funds.

When Class Code 221 and Appropriation Index R1x must be used for ALL accounting entries for local capital projects in local proprietary funds:

| Fund | Class Code | Appropriation Index |

|---|---|---|

| 522 – Services & Activities Fund (S&A) | 221 | R12 |

| 524 – Bookstore | 221 | R14 |

| 528 – Parking | 221 | R18 |

| 569 – Food Service | 221 | R19 |

| 570 – Other Auxiliary | 221 | R17 |

| 573 – Student Housing | 221 | R13 |

And for capital projects in Funds 145 and 147.

| Fund | Class Code | Appropriation Index |

|---|---|---|

| 147 – Local Capital Projects | 221 | R10 |

| 145 – Grants | 221 | R15 |

An appropriation index is not required to be used with any accounts in any other local funds.

10.40.40.2 Grant Funded Capital Projects (RXX)

In most circumstances Fund 145 requires the use of Class beginning with 1 and without an Appropriation Index. When a college receives grant funds to be used for a capital project, Fund 145 must use Appropriation R15 with Class 221 (used for all local capital projects).

10.40.40.3 Fund Project Combinations Required (FND_PRJ)

Requires the following funds to always use a Project ID (in addition to other required fields:

| Fund | Description |

|---|---|

| 057 | St Bldg Contr Fund |

| 060 | CTC Cap Project |

| 145 | Grants |

| 147 | Local Capital Projects |

| 253 | Education Const Fund |

| 357 | Gardner-Evans Constr |

| 23N | Model Toxics Control Capital |

| 26C | Climate Commitment Fund |

| 26V | Capital Community Assistance |

The PC Business Unit is required to select/enter a Project ID. When a Project ID is entered the Activity and Analysis Type (An Type) are also required. When PC Business Unit is entered in the transaction, the Project, Activity and Analysis Type are also required. A pop up message will indicate fields that must be completed.

10.40.40.4 Projects Not Allowed in Fund 146 (FUND146)

Other than the funds noted above, projects are allowed but not required.

However, projects are prohibited in Fund 146. This rule was created because the college system wanted to be able to record some grants and contracts without a project. If a college wishes to use a project with a grant or contract, Fund 145 should be used.

10.40.50.1 Building/Innovation Expense Prohibited (Z60-Z61)

Fund 060 Appropriation Index Z60 and Fund 561 with Appropriation Index Z61 are prohibited from recording expenses (accounts like 5xxxxxx).

This rule prohibits expenses in the following Fund Appropriation Index combinations since these Fund-AIs are intended for recording tuition revenue and remitting the funds to State Treasurer only:

- 060-Z60 Building Fee

- 561-Z61 Innovation Fee

10.40.50.2 Subsidiary Accounts Required (SUBS_ACCT)

This rule requires a subsidiary value (Due to/Due From) when a receivable or payable is recorded due to another fund, college or state agency.

The following accounts:

| Account | Description |

|---|---|

| 1010170 | Due From Other Funds Intern ST |

| 1010180 | Due From Other St Agencies ST |

| 1100030 | Due From Other Funds Intrnl LT |

| 2012040 | Due to Other Funds Internal ST |

| 2012050 | Due to Other State Agencies ST |

| 2130030 | Due to Other Funds LT |

| 4030140 | Interfund Transfer In |

| 4030150 | Interfund Transfer Out |

Then a value is required in the Subsidiary field. The allowable values are provided using the drop-down list. Subsidiary values are in the following format:

- Interfund Transactions – fff000 where ‘fff’ equals the 3-digit fund.

- Intercollege Transactions – 6990cc where ‘cc’ equals the last two digits of the college agency code. For example, if Yakima Community recorded an intercollege transaction with Skagit, Yakima would use 699074. At the same time Skagit would use the opposite Due To/From with 699091 in the subsid field.

- Interagency Transactions – aaaacc where ‘aaaa’ equals the 4-digit state agency value and ‘cc’ equals the last two digits of the college agency code. For transaction between the Student Achievement College (agency # 3400) and Peninsula College (agency # 0665) Peninsula College would use subsid 340065.

10.40.50.3 Restrict Government Funds in Asset Management (AMFNDS)

Governmental funds should not be allowed in Asset Management - fund should always be 997, no approp and class 211 for all governmental assets. This rule defines the valid funds, appropriation index, class and account.

Sequence 1

This sequence/part of the rule allows all accounts to be used with class 221 only, without an appropriation index in Fund 997 only.

Sequence 2

This sequence/part of the rule allows the following funds (using the AMFUNDS NON-STATE node of the CE_FUNDS tree:

| Fund | Description |

|---|---|

| 440 | Store |

| 443 | Central Data Processing |

| 444 | Central IT Services |

| 448 | Printing Fund |

| 450 | HE Other Facilities |

| 460 | Motor Pool |

| 522 | Associated Students |

| 524 | Bookstore |

| 528 | Parking |

| 569 | Food Service |

| 570 | Other Auxiliary Enterprises |

| 573 | Housing & Food |

To use the appropriation indexes (using the ALL_APPROPS node of the CE_APPROPRIATONS tree) and to use no appropriation (using the NO_APPROPS node of the CE_APPROPRIATONS tree) to limit the appropriations allowed in Asset Management.

10.40.50.4 Fund 444 – Only State Board (FUND444-NA)

This rule prohibits colleges from recording any entries in Fund 444 since this fund is to be used only by the State Board.

10.40.60.1 HCM Departments (HCM_DEPTS)

This rule prohibits the use of HCM departments in the general ledger (HCM departments are used to define organization personnel structure). It uses the CE_OPER_UNIT tree which includes ALL college Operating Units as the anchor.

The HCM_DEPTS tree defines departments (98500-99999) NOT allowed to be used in the general ledger.

10.30.65 State Purpose - IT Costs << 10.40 >> 20 State Operating Budget