ctcLink Accounting Manual | 10.30.45 Chart of Accounts (COA) Framework

10.30.45 Chart of Accounts (COA) Account Framework

2022-06-30

The framework was designed to allow for a simplified method of the preparation of financial statements. The accounts are broken out in five levels to align with college business-type activity reporting. The framework was created with a hierarchy of five (5) levels and field length of seven (7):

- Account Type (assets, liabilities, equity, revenue, expenditures) Monetary Account Type in PeopleSoft.

- Account Classification (current, non-current, operating, non-operating, etc.)

- Reporting Class (cash and cash equivalents, short-term, long-term, etc.)

- Reporting Sub-Class (non-student, student, non-depreciable, depreciable, etc.)

- Detail Chartfield Value (exempt staff salary, faculty salary, Pell grant expense, interest expense and revenue, etc.)

All accounts in hierarchy levels 1 through 4 are budgetary only (colleges may budget at these levels but accounting activity is not allowed to be recorded in these accounts).

10.30.45.1 Asset Accounts (Assets)

See also: 10.30.45.1 Asset Accounts Types and Classifications

| Hierarchy Level | Hierarchy Level Account Range | Hierarchy Level Budgetary Account | Hierarchy Level Lead Account Description |

|---|---|---|---|

| Account Type | 1000000-1999999 | 1000000 | Assets |

| Account Classification | 1000000-1099999 | 1000002 | Current Assets |

| Reporting Class | 1000000-1009999 | 1000003 | Cash and Cash Equivalents |

| Reporting Class | 1010000-1019999 | 1010003 | Short-Term Receivables |

| Reporting Sub-Class | 1010000-1010999 | 1010004 | Non-Student Accts Receivable |

| Reporting Sub-Class | 1011000-1011999 | 1011004 | Student Accounts Receivable |

| Reporting Class | 1020000-1029999 | 1020000 | Short-Term Investments |

| Reporting Class | 1030000-1039999 | 1030000 | Inventories |

| Reporting Class | 1040000-1049999 | 1040000 | Prepaid Expenses |

| Account Classification | 1100000-1199999 | 1100002 | Non-Current Assets |

| Reporting Class | 1100000-1109999 | 1100003 | Long-Term Receivables |

| Reporting Sub-Class | 1100000-1100999 | 1100004 | Non-Student A/R |

| Reporting Sub-Class | 1101000-1101999 | 1101004 | Student Accounts Receivable |

| Reporting Class | 1110000-1119999 | 1110003 | Long-Term Investments |

| Reporting Class | 1120000-1129999 | 1120003 | Capital Assets |

| Reporting Sub-Class | 1120000-1120999 | 1120004 | Non-Depreciable Capital Assets |

| Reporting Sub-Class | 1121000-1121999 | 1121004 | Depreciable Capital Assets |

| Account Classification | 1200000-1299999 | 1200002 | Deferred Outflows of Resources |

10.30.45.2 Liability Accounts (Liabilities)

See also: 10.30.45.2 Liability Account Types & Classifications

| Hierarchy Level | Hierarchy Level Account Range | Hierarchy Level Budgetary Account | Hierarchy Level Lead Account Description |

|---|---|---|---|

| Account Type | 2000000-2999999 | 2000000 | Liabilities |

| Account Classification | 2000000-2099999 | 2000002 | Current Liabilities |

| Reporting Class | 2000000-2009999 | 2000003 | Accounts Payable |

| Reporting Sub-Class | 2000000-2000999 | 2000004 | Accounts Payable Gen. |

| Reporting Sub-Class | 2001000-2001999 | 2001004 | Other Accounts Payable Liabilities |

| Reporting Class | 2010000-2019999 | 2010003 | Accrued Liabilities |

| Reporting Sub-Class | 2010000-2010999 | 2010004 | Accrued Liabilities General |

| Reporting Sub-Class | 2011000-2011999 | 2011004 | Payroll Liabilities / HCM Payables |

| Reporting Sub-Class | 2012000-2012999 | 2012004 | Due-To College or Other State Agency |

| Reporting Class | 2020000-2029999 | 2020003 | Compensated Absences |

| Reporting Class | 2030000-2039999 | 2030003 | Deposits Payable |

| Reporting Class | 2040000-2049999 | 2040003 | Unearned Revenue |

| Reporting Class | 2050000-2050999 | 2050003 | Current Portion, Long Term Debt |

| Account Classification | 2100000-2199999 | 2100002 | Non-Current Liabilities |

| Reporting Class | 2100000-2109999 | 2100003 | Compensated Absences |

| Reporting Class | 2110000-2119999 | 2110003 | Pension Liability |

| Reporting Class | 2120000-2129999 | 2120003 | Unamortized Premium |

| Reporting Class | 2130000-2139999 | Long Term Debt | |

| Reporting Class | 2140000-2149999 | 2140003 | Long Term Installments and Leases Payable |

| Account Classification | 2200000-2299999 | 2200002 | Deferred Inflows of Resources |

10.30.45.3 Equity Accounts (Equity)

See also: 10.30.45.3 Equity Accounts Types & Classifications

| Hierarchy Level | Hierarchy Level Account Range | Hierarchy Level Budgetary Account | Hierarchy Level Lead Account Description |

|---|---|---|---|

| Account Type | 3000000-3999999 | 3000000 | Equity |

| Account Classification | 3000000-3099999 | 3000002 | Net Investment in Capital Assets |

| Account Classification | 3100000-3199999 | 3100002 | Other Equity |

10.30.45.4 Revenue Accounts (Revenue)

See also: 10.30.45.4 Revenue Accounts Types & Classifications

| Hierarchy Level | Hierarchy Level Account Range | Hierarchy Level Budgetary Account | Hierarchy Level Lead Account Description |

|---|---|---|---|

| Account Type | 4000000-4999999 | 4000000 | Revenue |

| Account Classification | 4000000-4099999 | 4000001 | Operating Revenue |

| Reporting Class | 4000000-4009999 | 4000005 | Student Tuition and Fees |

| Reporting Class | 4010000-4019999 | 4010000 | Auxiliary Enterprise Sales |

| Reporting Class | 4020000-4029999 | 4020000 | Grants and Contracts |

| Reporting Sub-Class | 4020000-4020999 | 4020001 | State Grants and Contracts |

| Reporting Sub-Class | 4021000-4021999 | 4021000 | Local Grants and Contracts |

| Reporting Sub-Class | 4022000-4022999 | 4022000 | Federal Grants and Contracts |

| Reporting Class | 4030000-4039999 | 4030000 | Other Operating Revenue |

| Reporting Class | 4040000-4049999 | 4040000 | Other Revenue and Financing Sources |

| Reporting Class | 4050000-4059999 | 4050000 | Interest on Loans to Students |

| Account Classification | 4100000-4199999 | 4100000 | Non-Operating Revenue |

| Reporting Class | 4100000-4109999 | 4100001 | Appropriations |

| Reporting Class | 4110000-4119999 | 4110000 | Federal Pell Grant Revenue |

| Reporting Class | 4120000-4129999 | 4120000 | Investment Income |

| Reporting Class | 4130000-4139999 | 4130000 | Other Non-Operating Revenue |

| Account Classification | 4200000-4299999 | 4200000 | Capital Revenues |

| Reporting Class | 4200000-4209999 | 4200001 | Capital Appropriations |

| Reporting Class | 4210000-4219999 | 4210000 | Cash Capital Contributions |

| Reporting Class | 4220000-4229999 | 4220000 | Non-Cash Capital Contributions |

10.30.45.5 Expense/Expenditure Accounts

See also: 10.30.45.5 Expenditure Accounts Types & Classifications

| Hierarchy Level | Hierarchy Level Account Range | Hierarchy Level Budgetary Account | Hierarchy Level Lead Account Description |

|---|---|---|---|

|

Account Type |

5000000-5999999 |

5000000 |

Expenses |

| Account Classification | 5000000-5099999 | 500000 | Operating |

| Reporting Class | 5000000-5009999 | 5000003 | Salaries and Wages |

| Reporting Class | 5010000-5019999 | 5010003 | Benefits |

| Reporting Class | 5020000-5029999 | 5020003 | Scholarships and Fellowships |

| Reporting Class | 5030000-5039999 | 5030003 | Supplies and Materials |

| Reporting Class | 5040000-5049999 | 5040003 | Capital Expenses |

| Reporting Class | 5050000-5059999 | 5050003 | Services |

| Reporting Class | 5060000-5069999 | 5060003 | Utilities |

| Reporting Class | 5070000-5079999 | 5070003 | Depreciation |

| Reporting Class | 5080000-5089999 | 5080003 | Other Expense |

| Reporting Sub-Class | 5080000-5080999 | 5080004 | Travel |

| Reporting Sub-Class | 5081000-5081999 | 5081004 | Other Expenses |

| Account Classification | 5100000-5199999 | 5100002 | Non-Operating |

| Reporting Class | 5100000-5109999 | 5100003 | Loss on Disposal |

| Reporting Class | 5110000-5119999 | 5110003 | Interest on Indebtedness |

| Reporting Class | 5120000-5129999 | 5120003 | Remittances |

10.30.45.6 Chartfield

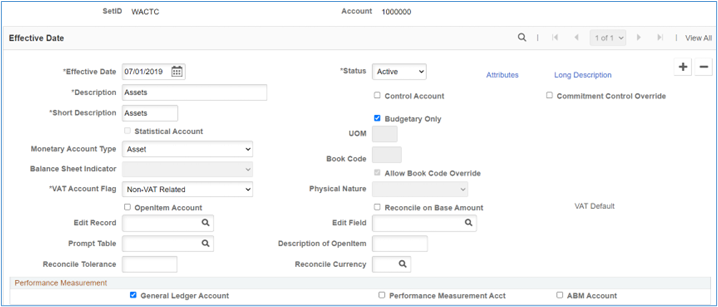

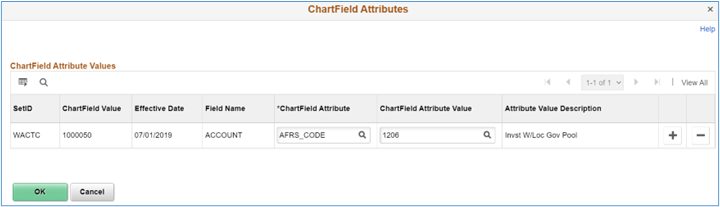

Since accounts are global, the SetID is always WACTC and is controlled by SBCTC staff. Each account has a number of configurable settings including Monetary Account Type, Statistical Account, Budgetary Only, Control Account and Attributes (crosswalk value to AFRS).

Figure 1: SetID

Figure 2: Chartfield Attributes

10.30.45.7 Statistical Chartfields

In addition to financial accounts, ctcLink also uses certain fields to track statistical values. These values should be excluded when searching or querying the Local ledger.

10.30.45.7.a Payroll Staff Months (SMO)

This is a non-fiscal statistical field used for recording payroll staff months within ctcLink. These values are generated in HCM and summarized by the accounting chartstring. SMO should not calculate for volunteers, employees in agency or custodial funds. It is unique to the CTC system and therefore not found in the SAAM manual.

However, these values cross-walked to AFRS and are used by OFM and the Legislature

to determine the CTC system FTEs by fund.

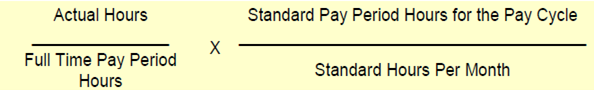

A non-faculty staff month is equal to 174 hours (the average available work hours

in a month). A staff month calculation is the percent of time an employee works relative

to the standard staff hours in a pay period. A full time employee should generate

.50 staff months each pay period.

Figure 3: Calculate Payroll Staff Months (SMO)

To calculate SMO: Divide Actual Hours by Full-Time Pay Period Hours; then multiply that sum by Standard Pay Period Hours for the Pay Cycle divided by Standard Hours Per Month.

The actual hours may vary depending on the type of employee. A full-time employee

should generate one SMO each month with 12 SMO equaling one FTE. For a full description

of the calculation please see the HCM Manual (future).

It is important to include staff months when making salary and benefit transfers between funds since it will result in incorrect reporting of FTE to the state.

Since SMO is not an accounting value, it does not record a debit and credit. It only reports a single line with a positive or negative value.

10.30.45.7.b State Allocation (SAL)

This is a non-fiscal statistical field used for recording state allocations by fund and appropriation. The values are added to ctcLink by State Board staff based upon the allocation schedule provided to the college by the Operating Budget director.

10.30.40 Program << 10.30.45 >> 10.30.50 Projects