ctcLink VPA Reconciliation Processes

VPA Reconciliation Report

Revised 2024-03-08

SBCTC has developed a VPA Reconciliation Report to assist colleges with the reconciliation process. This report can be used to compare your Payroll & Non-Payroll Expenses in State Funds to the Revenue Reimbursements from the State Treasurer recorded in Fund 790.

By Year-End, all State Fund expenses (Funds 001, 08A, 24J, 057, 060) for the year MUST match the Revenue Reimbursements received and recorded in Fund 790 / Class 285 / Dept 98499.

What is VPA?

The Vendor Payment Advance (VPA) is unique to the community and technical college system. Since the colleges maintain their own bank accounts, we are not required to use the State Treasurer to pay our vendors directly.

The VPA allows us to provide funds up front to help with cash flow (the Advance), and provides a monthly reimbursement process when expending Treasury Funds (001, 057, 060, 08A).

A VPA is set up as an initial advance, and then a monthly reimbursement processes each month as the year progresses.

The “Advance” must be returned to the State Treasurer at the end of each biennium.

How to Pull the VPA Reconciliation Report

Navigate to the Report

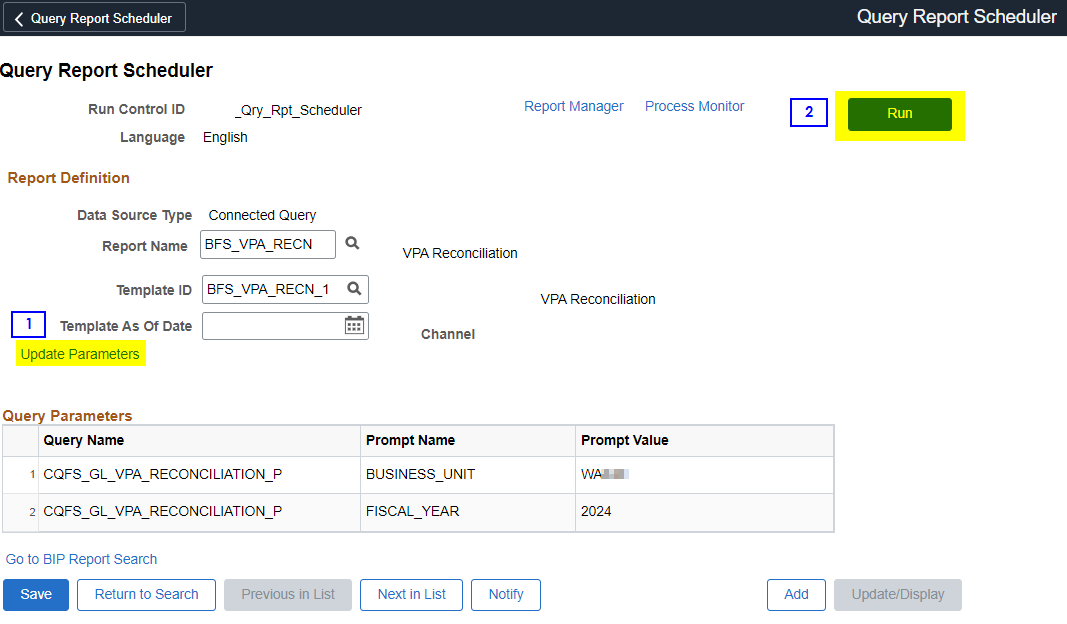

- Reporting Tools > BI Publisher > Query Report Scheduler

- When running the report for the first time, you will need to click on the tab for “Add a New Value” and enter a Run Control ID name. Find the Report name and click “Run”. Once it is processed, the report is available in Report Manager.

- Report Name = BFS_VPA RECN

Fig. 1 Query Report Scheduler

Parameters = Your College’s Business Unit and Fiscal Year

Examples of Report Data

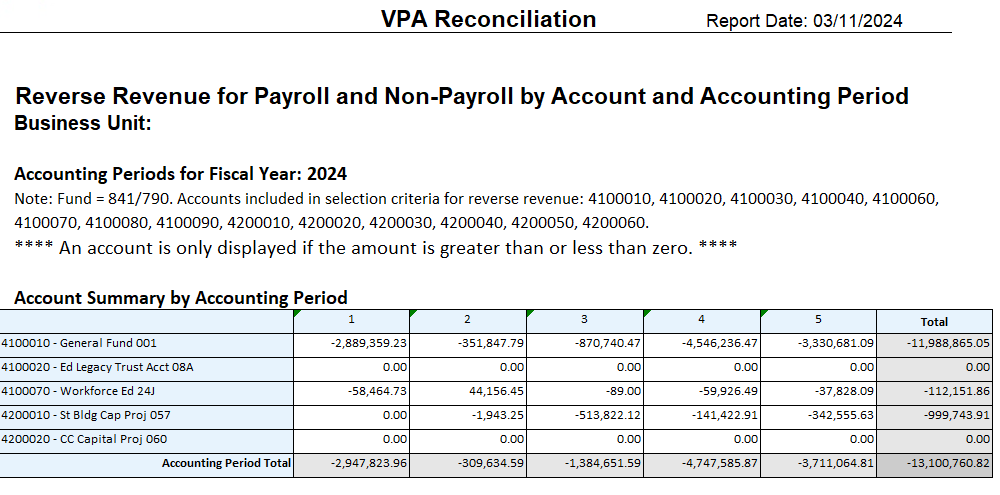

You will see different tabs with information:

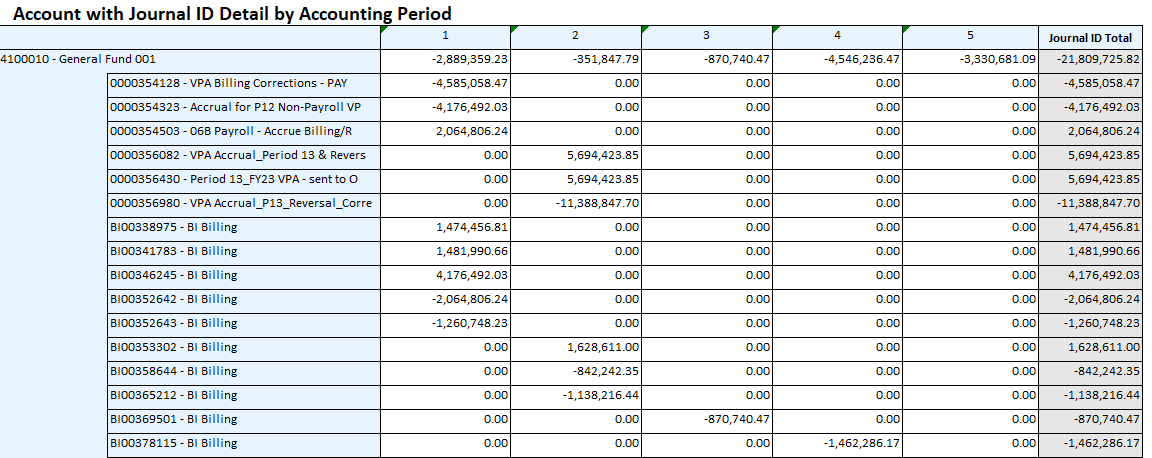

- Revenue Reimbursements posted into Fund 790 for payments received from OST. This breaks out the Revenues

by Account for each fund and provides details in total for each period, or by Journal

ID.

- 4100010 – Fund 001

- 4100020 – Fund 08A

- 4100070 – Fund 24J

- 4200010 – Fund 057

- 4200020 – Fund 060

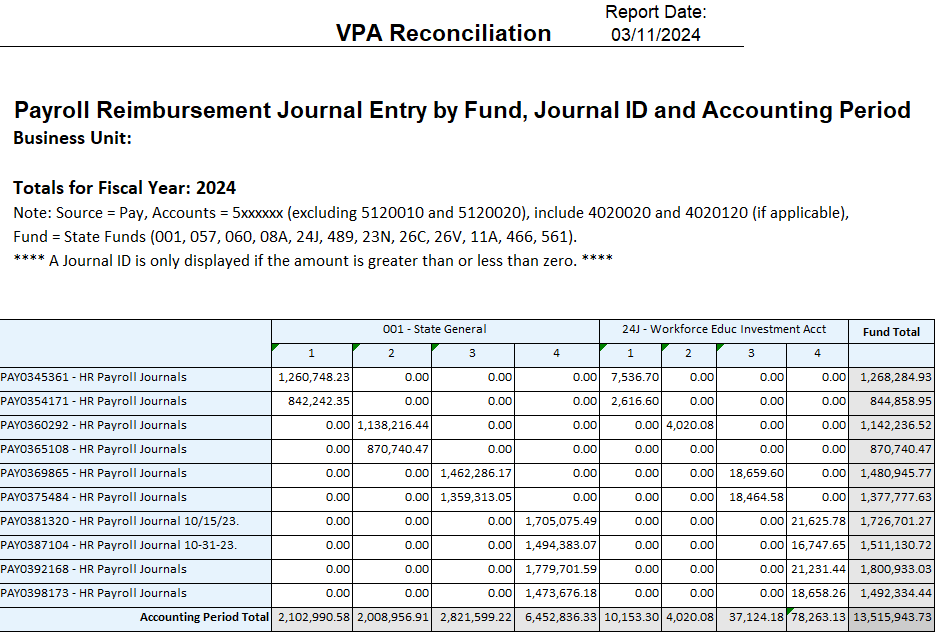

- Payroll Expense Details by month/period/journal

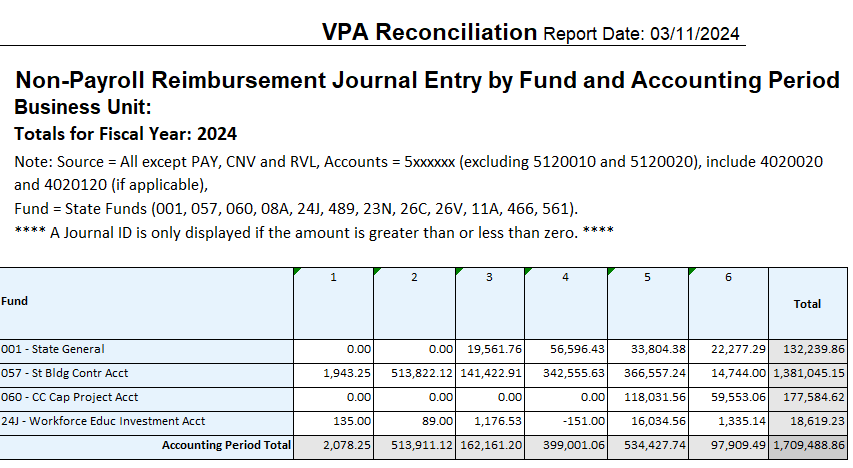

- Non-Payroll Expense details by month/period/journal

Fig. 2a VPA Reconciliation Report: Reverse Revenue for Payroll & Non-Payroll, Account Summary

Fig. 2b VPA Reconciliation Report: Account With Journal ID Detail by Accounting Period

Fig. 3 Payroll Reimbursement Journal Entry

Fig. 4 Non-Payroll Reimbursement Journal Entry

Suggested Process to Reconcile

Reconcile after month-end close and after the monthly VPA Express Bill has been processed and paid.

- Make sure the expenses for each period in the Payroll tab and Non-Payroll tab match up to an amount in the Fund 790 Revenues from OST that have been Recorded.

- Make sure the amounts agree by Fund/Account.

- Each state Fund’s expenses should equal the revenue in that State Revenue Account in 790-285-98499.

- Example – the Revenues posted in Fund 790 in Account 4100010, must equal the Expenses in State Fund 001.

- Possible differences/errors

- If a college changes the Funds on a PAY Journal before posting it to the GL, it could cause a discrepancy between the GL Expense totals on the PAY journal and the Revenue Deposit from Central Payroll. Central Payroll deposits are based on HCM Report totals by Fund.

- Try to reconcile at least Quarterly, monthly, if possible, to catch mistakes as soon as possible.

- By year end, All State Fund Expenses = Fund 790 / class 285 / Dept 98499 Revenues by Fund/Account.

- When the Year-End entries are posted in Period 132/Period 133, and the Revenues are moved to each state fund/Appropriation Index (101, 3E0, etc.), this will ensure the Revenues equal the Cash Expenditures = 0 Fund Balance in State Funds.