Running Start/International Contract Revenue Remittance

Remittance Background

Rev. 2024-03-25

During its June 2021 meeting, the State Board adopted a resolution which broadened the base for collecting support payments for ctcLink.

SBCTC sent a memo dated July 15, 2021 to college business officers via the Business Affairs Commission (BAC) list regarding the ctcLink Project and Funding Changes.

Effective with the 2021-22 fiscal year, SBCTC collected 2.5% of all Running Start Revenues and 3% of International Contract Revenues from colleges to help support ctcLink implementation costs.

What’s changed?

Beginning Fiscal Year 2024 (July 2023) and beyond, the contribution percentage rates decreased to 1.5% of Running Start revenues and 2.5% of International Contract Revenues to be remitted to SBCTC.

The methodology implemented was for colleges to calculate and remit amounts to SBCTC based on the specific guidance/account coding provided below.

Remittance Schedule

As with the remittance for the Building and Innovation Fees to the State Treasurer, the SBCTC Accounting team suggests colleges remit Running Start and International Contract Revenues monthly, or at a minimum, quarterly.

- Because these revenues tend to be focused during specific months throughout a quarter, it is possible individual colleges may not have a remittance each month.

- It is also possible some colleges may not have International Contract student revenues, as they may claim all International Students towards State enrolled FTEs.

The following Revenue Accounts are to be used to clearly identify the revenues collected and calculate the % of revenues owed to SBCTC:

- 4021067 – Running Start

- 4021065 – International Contract

Please ensure all Item Types, AR Charge Codes, etc. for Running Start and International Contract are using the following accounts.

Colleges are to use Fund 146 for both RS and IC.

To ensure our system accurately accounts for these inter-agency transactions and does not duplicate expenditures and revenues, colleges and SBCTC will use the following coding:

| Organization | Account | Coding Notes |

|---|---|---|

| Colleges | Expenditure Account 5081390 | Use 5081390 to remit to SBCTC using the same Fund 146 Chartstrings above used to record the revenue. |

| SBCTC | Revenue Account 4020120 (equivalent to Sobj NZ in AFRS) |

Use 4020120 to record payments received from the colleges.Use a Fund 146 Chartstring to record this revenue received. |

Monthly Process

Occurs after each month-end close (Periods 1 to 13).

Run query to identify Revenues collected for Running Start (4021067) and International Contract (4021065). This BI Publisher Query Report will calculate your Remittance amount for each period.

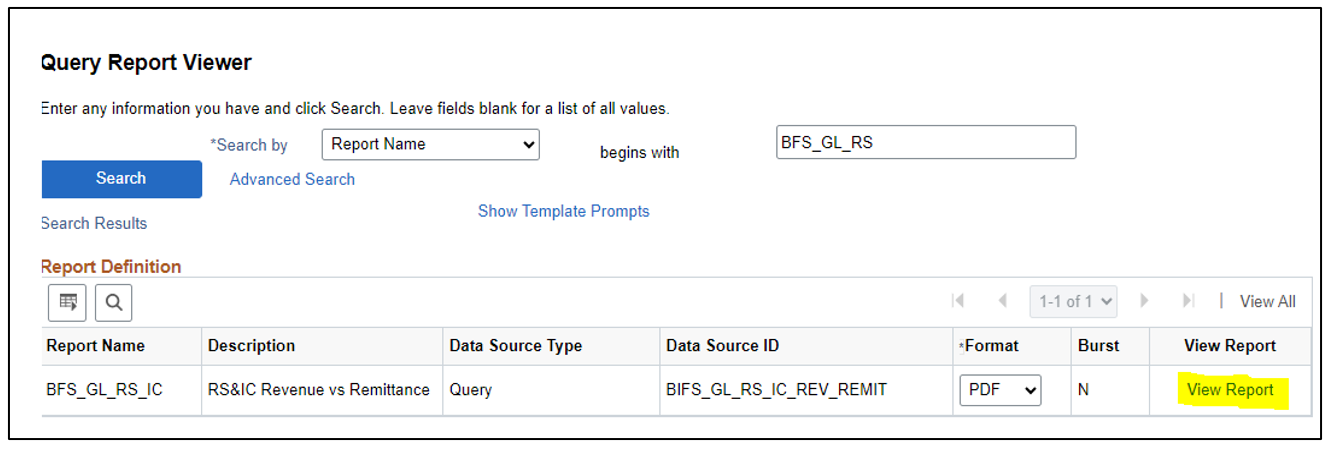

- Navigator: Reporting Tools > BI Publisher > BIP Query Report Viewer

- Report Name: BFS_GL_RS_IC

Fig. 1 Query Report Viewer

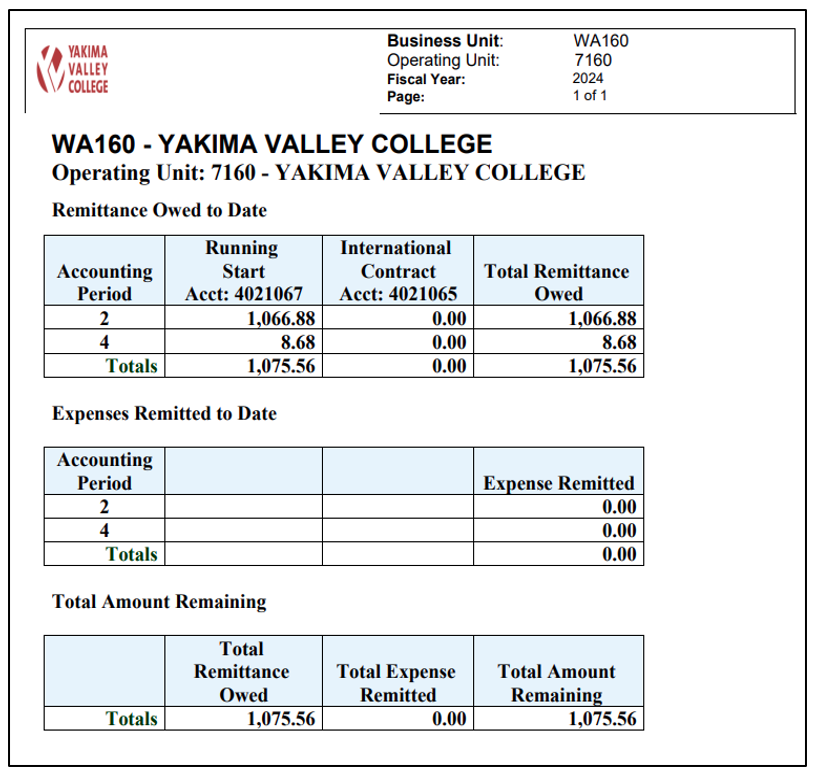

Select View Report and enter your college Unit # and Year. The Report will look like this:

Fig. 2 Remittances and Expenses remitted, and total remaining to remit

- The Report shows Remittances owed for each period, Expenses remitted using account 5081390, and total amount remaining to be remitted.

- For FY24, the Amount Remaining to Remit could be negative if you are paying prior year remittances owed.

- It is always a good idea to compare the data on this report to a GL query of those revenue accounts for the same period, multiplied by the remittance % to reconcile/verify the amounts on the report.

See Enter a Quick Invoice Voucher at the ctcLink Reference Center for instructions.

- Supplier: V000009035 (SBCTC)

- Invoice Lines:

- Account 5081390

- Fund 146

- Class 1xx

- Department xxxxx (college determined)

- This will debit 5081390 / credit 2000010

- Complete the AP Check Payment Process

- ctcLink will record the payment to SBCTC in the GL Dr 2000010 / Cr 1000070

SBCTC Accounting staff will need to transfer expenses out of Fund 444 to the 146 Chartstring where the Revenues from college remittances were posted.

The expenses need to match the amount of revenues to offset the NZ Credit in AFRS (revenue account 4020120 in ctcLink).