ctcLink Accounting Manual | 50.50 Financial Aid

50.50 Financial Aid

Effective Date: 2024-10-14

50.50.10 Types of Grants and Aid

Currently, the U.S. Department of Education (ED) offers four primary federal grants to students attending four-year colleges or universities, community colleges, and career schools:

- Federal Pell Grants - awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor's, graduate, or professional degree. Every eligible student receives funding.

- Federal Supplemental Educational Opportunity Grants (FSEOG) - Each college receives a certain amount of FSEOG funds each year from ED’s office of Federal Student Aid. Once the full amount of the school’s FSEOG funds has been awarded to students, no more FSEOG awards can be made for that year.

- Iraq and Afghanistan Service Grants - provides money to college or career school students to help pay their education expenses if they meet certain eligibility criteria.

- Teacher Education Assistance for College and Higher Education (TEACH) Grants - requires students to agree to complete a teaching service obligation as a condition for receiving the grant, and if the student doesn't complete the service obligation, the TEACH Grant will be converted to a loan that must be repaid, with interest.

Additionally, other grants targeting specific student groups are offered through the U.S. Department of Education (ED) or other Federal agencies (following is a partial list):

- Bureau of Indian Affairs – provides supplemental financial assistance to eligible American Indian and Alaska Native scholars entering college who are seeking an associate or baccalaureate degree from a nationally accredited institution.

- Basic Food Employment & Training (BFET) – the US Department of Agriculture provides financial assistance to students receiving or eligible to receive federal SNAP benefits. Funding the community college system is provided via DSHS and awarded to colleges by the State Board.

- Perkins Grants - the US Department of Education provides financial assistance to students in career and technical training programs. Funding for the community college system is provided via WTECB and awarded to colleges by the State Board.

- WorkFirst - the US Department of Health and Human Services provides financial assistance to students receiving federal TANF benefits. Funding to the community college system is provided via DSHS and awarded to colleges by the State Board.

- Veterans Affairs Chapter 33/31 – the US Department of Veteran Affairs provides financial assistance to qualified veterans. In most instances, this aid is not recorded with financial aid item type. Rather, payments are processed through the Third Party payment system.

- Veterans Affairs Chapter 35 – the US Department of Veteran Affairs provides education benefits to qualified dependents and survivors of service members.

From the Washington State Student Achievement Council website, June 2024. Other state-funded financial aid may be available which is not listed.

Need-Based Programs

Washington College Grant (WA Grant)

The Washington College Grant (formerly named the State Need Grant) is one of the most generous and flexible financial aid programs in the country. People of all ages from low- and middle-income families may qualify to get money for college, career training, and participating apprenticeships. Funding is guaranteed to eligible students.

College Bound Scholarship

The College Bound Scholarship provides an early promise of financial aid to students from low-income families.

State Work Study

State Work Study is financial aid for low- and middle-income students. Qualifying students get an approved job, on- or off-campus, to support their education.

Passport to Careers

The Passport to Careers program helps students from foster care and unaccompanied homeless youth attend and succeed in college, apprenticeships, and pre-apprenticeship programs.

Washington State Opportunity Scholarship

The Washington State Opportunity Scholarship (WSOS) helps low- and middle-income Washington students earn degrees, certificates, or apprenticeships in high-demand trade, health care, or STEM fields and launch careers in Washington State. This program is not administered by the Washington Student Achievement Council. Learn more at the WSOS website.

Opportunity Grant

The Opportunity Grant program helps low-income students complete up to one year of college and a certificate in a high-wage, high-demand career. This program is not administered by the Washington Student Achievement Council. Learn more at the SBCTC Opportunity Grant web page.

Merit-Based Programs

American Indian Endowed Scholarship

The American Indian Endowed Scholarship benefits eligible students who have close social and cultural ties to an American Indian tribe or community in Washington State.

Washington Award for Vocational Excellence (WAVE)

The Washington Award for Vocational Excellence (WAVE) recognizes graduating high school seniors and community & technical college students for outstanding performance in career and technical education (CTE) programs. This program is administered in partnership with the Workforce Training & Education Coordinating Board.

Workforce Programs

Teacher Programs

The Washington State Educator Workforce programs provide financial aid to attract and retain teachers. Participants work in subjects or locations of high need known as shortage areas.

Washington Health Corps

Washington Health Corps programs support licensed health professionals in providing primary care at approved sites in critical shortage areas.

National Guard Grant

The National Guard Postsecondary Education Grant helps members of the Washington National Guard get an undergraduate degree or certificate.

Aerospace Loan Program

The Aerospace Loan Program supports training for entry-level aerospace workers.

Worker Retraining

The Worker Retraining program supports training for workers who have lost their jobs due to economic changes and for those receiving Unemployment Insurance (UI) benefits. Funds are provided by an allocation from the State Board.

Institutional Financial Aid (3.5% Funds)

Each college is required to deposit 3.5% of the operating fee portion of tuition into the Institutional Financial Aid fund to award needy students either as loans or grants.

- Athletic Scholarships

- College Endowments & Private Scholarships held by the college

- Student Services & Activities (student government may award scholarships)

Sources of local financial aid may be available from organizations such as:

- College Foundation

- Local school direct

- College Endowments

- Student Services & Activities (student government may award scholarships)

- Private Scholarships

Loans are not reported to IPEDS since these are a method of self-pay:

- Subsidized Direct Loans

- Unsubsidized Direct Loans

- PLUS Loans

- PLUS Loans - Parent

- Private Loans

Student may also have other funding sources that are not reported to IPEDS since they are funds earned by students through private service or deposits:

- GET

- 529 College Investment Plans

- AmeriCorps

- Veterans Administration (Chapter 33 and 35)

50.50.20 Financial Aid Item Types

It is critical for all departments involved in student aid (Student Services, Financial Aid, Student Finance and Financial Services) to establish a good working relationship.

All financial aid Item Types have been assigned Keyword 1.

The values in Keyword 1 should reflect the type of aid as reported in IPEDS.

- Keyword 2 is currently not used

- Keyword 3 is used to indicate whether the item is Global, Local, SBCTC, Reserved or Do Not Use.

Keyword 1 List

| KEYWORD1 | Description |

|---|---|

| FED_OTHER | Federal Other |

| FED_OTH_ND | Federal Other Non-Disbursable |

| FED_PELL | Federal Pell |

| FED_WRKST | Federal WorkFirst |

| INSTITUTN | Institutional |

| INST_ND | Institutional Non-Disbursable |

| LOAN_FED | Federal Loan |

| LOAN_OTHER | Other Loan |

| ND | Non-Disbursable |

| NOT_REP | Not Reported |

| NOT_REP_ND | Not Reported Non-Disbursable |

| PLUS | PLUS Loan |

| PRIVATE | Private Aid |

| PRIVATE_ND | Private Aid Non-Disbursable |

| STATE | State |

| STATE_ND | State Non-Disbursable |

| VETERAN | Veteran |

| VETERAN_ND | Veteran Non-Disbursable |

| WORKSTUDY | Work Study |

All financial aid awards and payments are controlled by item types. To make it easier to work with financial aid item types, they have been structured to allow for better grouping in the Item Type trees. (Due to varying staff employed during deployment, numbering is not 100% consistent.)

Global Financial Aid Numbering Convention

| 1st Position (Always “9”) |

2nd Position (Aid Type) |

3rd Position (Funding Source) |

4th – 8th Positions (filler) |

9th – 12th Positions (Program Specific) |

|---|---|---|---|---|

| 9 = Financial Aid | 1 = Grants 2 = Scholarship 3 = Work Study 4 = 3rd Party Sponsorship 5 = VA Benefits 6 = Loans 7,8,9 = not used |

1 = Federal 2 = State 3 = Institution 4 = Other |

Zeros “0” | Numeric Values |

In ctcLink, Item Types beginning with “9” are reserved for financial aid and then reserved by the first 3 digits for a more detailed breakdown:

- 911 Direct Federal financial assistance

- 912 State financial assistance (including federal aid received through a state agency)

- 913 Institutional financial assistance

- 914 Other financial assistance

- 920 Passport/Other

- 921 Federal Scholarships

- 922 State Scholarships

- 923 Institutional Scholarships

- 924 Other Scholarships

- 931 Federal Work Study

- 932 State and WorkFirst Work Study

- 933 Institutional Work Study

- 934 Athletic Work Study

- 940 Tuition assistance programs

- 944 Agency funding

- 951 Federal VA benefits

- 952 Other veteran financial assistance

- 953 Veteran Waivers

- 954 Basic Allowance for Housing

- 960 Miscellaneous Student Loans

- 961 Subsidized/Unsubsidized/PLUS Loans

- 963 Other Loans

- 971 Other veteran financial assistance

- 972 State Employee Tuition Waiver

- 973 Miscellaneous Aid

- 974 Non-Resident Waivers

- 981 Colville Book Fund

- 999 Not Defined

50.50.30 Financial Aid Item Type Configuration

Financial aid Item Types are configured to apply the correct accounting when the Student Financials Accounting Line table records are created. Prior to this, all student account activity is listed by Item Type only.

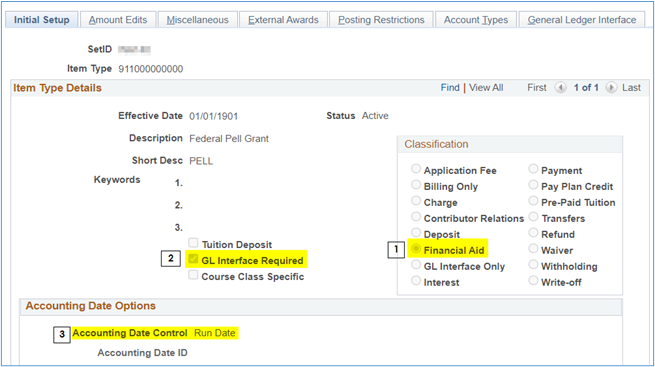

50.50.30.1 Initial Setup Tab

- Financial Aid item types process transactions differently than charge item types, for example.

- The GL interface box is checked and an accounting chartstring must be configured.

- The Accounting Date Control is set to Run Date. Since the SF journals are run nightly, the accounting date in the GL will be the current date. Therefore, any financial aid that is processed on the last day of the month will be recorded in that fiscal month. Financial aid processed on the 1st will be recorded in the next fiscal month (even if the prior fiscal month is still open).

Image: Initial Setup Tab

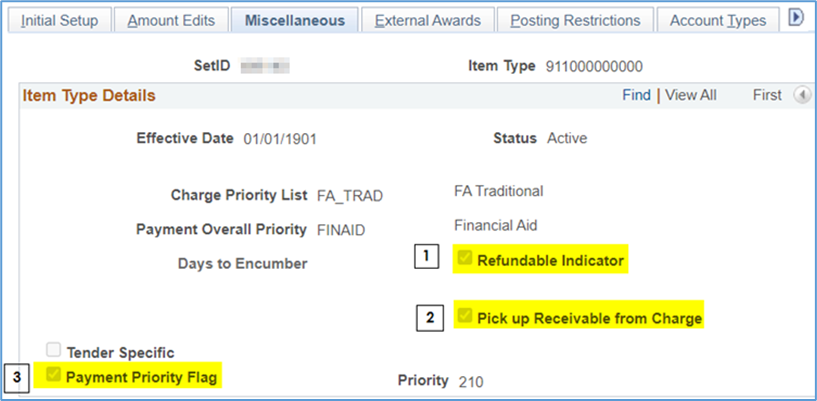

50.50.30.2 Miscellaneous Tab

- This tab determines if students are to receive payment for the unapplied portion of the financial aid.

- The applied payments will use the accounting from the original charges.

- The payment priority level determines the order of applied items.

Image: Miscellaneous Tab

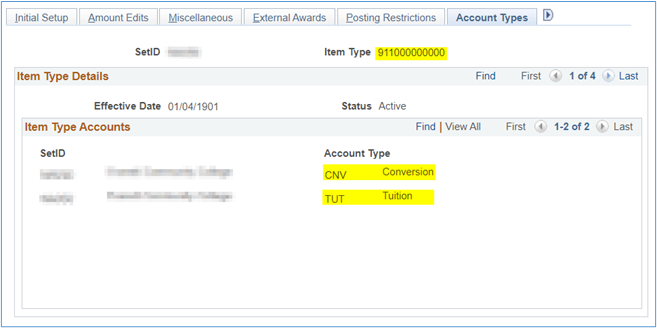

Each financial aid item type will list the Account Types allowed to be paid with this funding source (each charge item will list one or more Account Types).

Whether the unapplied balances are allowed to be refunded is determined by the Refundable Indicator on the Miscellaneous Tab.

Image: Account Types Tab

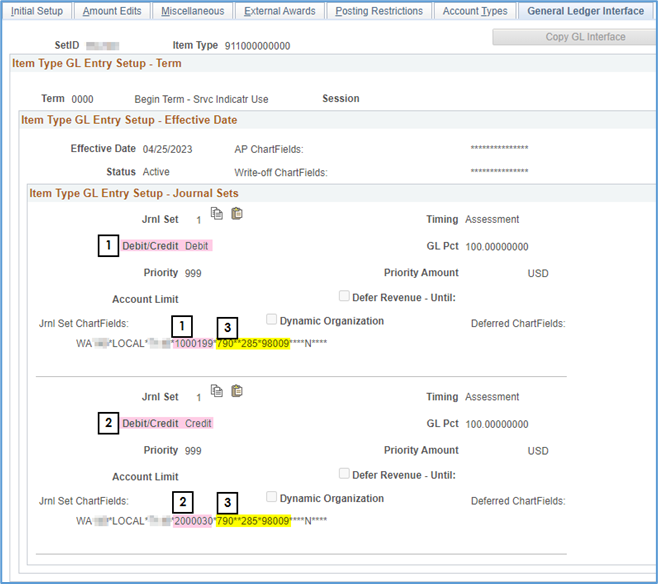

- The debit field should be configured to internal cash (1000199) for all financial aid item types.

- The credit field should be configured to Student Liability Short-Term (2000030) for all financial aid item types. This account is used only if any unapplied financial aid remains after eligible charges have been paid and the student is owed a refund.

- All financial aid item types use 790-285-98009. However, since the item type has the Pick up Receivable from Charge box checked (see above) these chartfield values are replaced when financial aid is applied and the cash balancing process runs.

Image: GL interface Tab

50.50.40 Second Journal Set (SJS)

The amount of financial aid received by a student is applied to the student account either as a:

- Payment of amounts due (relieves the accounts receivable and records internal cash)

- Refund to the student (initially creates a liability and then when refunded relieves the liability and credits internal cash).

Since these transactions are considered college expenses, a second accounting entry is required. This is accomplished by the ‘Second Journal Set’.

Every financial aid item type that records internal cash (1000199) as a payment requires a Second Journal Set. Several queries exist in ctcLink Student Financials to assist colleges in ensuring all required item types have a second journal set.

1 - QCS_SF_2ND_JOURNAL_SET - GL 2nd Journal Set Setup

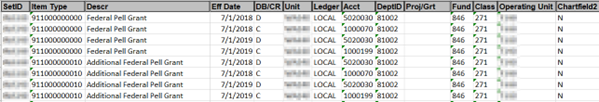

This query shows only the item types with 2nd Journal Set configured. This allows colleges to review existing 2nd Journal Sets for correct accounting. Notice this college initially set up the 2nd journal set incorrectly with Cash in Bank (1000070) and then corrected it effective 7/1/2019.

Image: GL 2nd Journal Set Setup

2 - QCS_SF_ITEM_1ST_2ND_ACCOUNTS - Item Type GL 1st & 2nd

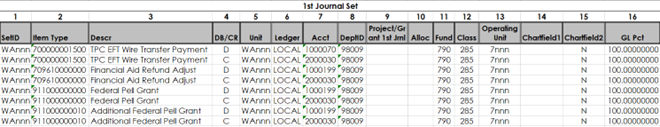

This query returns all Item Types with both the 1st Journal Set and the Second Journal Set (if one exists). This allows college to review all First Journal Sets to determine if any journal should have a Second Journal Set but does not.

Image: GL1 item type query

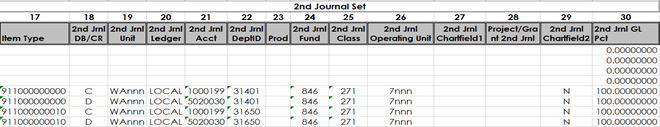

Image: GL2 item type query

For a discussion of process and accounting with the SJS see CLAM 50.30.50.

50.50.50 Accounting for Financial Aid

The community and technical colleges use Fund 846 (Grants In Aid) to record all student financial assistance, Fund 849 to record student loans and Fund 850 for Work Study awards.

Class codes are determined by type of assistance provided:

| Class | Description/Use |

|---|---|

| 271 | Scholarships |

| 272 | Loans |

| 273 | Off-Campus CWS-Fed |

| 274 | Off-Campus CWS-State |

| 275 | Waivers |

| 276 | Nursing Loan |

| 277 | NDSL |

| 278 | NDSL |

| 279 | Institutional Financial Aid |

The specified funds and class codes are used to comply with NACUBO guidance and allow for easy identification of types of expenditures and/or revenue for IPEDS (Integrated Postsecondary Education Data System) reporting which is required by the Department of Education.

Department codes for each source of financial aid is determined by individual colleges.

As noted above, ALL financial aid item types should be configured with the same debit and credit chartstring and the ‘Pick Up Receivable from Charge’ box should be checked.

With this box checked any payments to pay off charges will be recorded in the chartstring of the original charge.

All unapplied payment amounts (debit 1000199 Internal Cash; credit 2000030 Student Liability) will be recorded in the chartstring shown in the Item Type (790-285-98009).

Therefore, student refund Item Types (59*) all use the same Fund-Class-Department to record refund payments to students.

Student tuition and are recorded with the following:

Charges

Tuition

Original tuition charges are distributed to the various funds as proscribed by state regulations.

| Account | Funds | Debit | Credit |

|---|---|---|---|

| Student Receivable | 149, 060, 522, 561, 860 | $750.00 | |

| Tuition Revenue(4000020, 4000030 or 4000040) | 149, 060, 522, 561, 860 | $750.00 |

Fees

Dedicated and miscellaneous fees are distributed to the various funds designated for specific uses.

| Account | Funds | Debit | Credit |

|---|---|---|---|

| Student Receivable | 148, 522, 528, etc. | $250.00 | |

| Fee Revenue (4000050 or 4000060) | 148, 522, 528, etc. | $250.00 |

Financial Aid Applied

When financial aid is applied, the entire cash amount is recorded in Fund 790-285-98009. The 2000030 liability is automatically created if the financial aid (or cash payment) applied exceeds the outstanding balance. For example, if the outstanding balance is $1,000 and the applied financial aid is $1,500, then:

| Account | Funds | Debit | Credit |

|---|---|---|---|

| Internal Cash | 790-285-98009 | $1,500.00 | |

| Student Receivable | 148,149, 060, 522, 528, 561, 860, etc | $1,000.00 | |

| Student Liability | 790-285-98009 | $500.00 |

Fund Balancing Custom Process

The fund balancing distributes the cash from Fund 790 (as demonstrated above) to all the receivable and payable chartstrings:

| Account | Funds | Debit | Credit |

|---|---|---|---|

| Internal Cash | 148,149, 060, 522, 528, 561, 860, etc | $1,000.00 | |

| Internal Cash | 790-285-98009 | $500.00 | |

| Internal Cash | 790-285-98009 | $1,500.00 |

Second Journal Set

The SJS records the expense and credit to internal cash in the appropriate chartstring. Most aid should be recorded in Fund 846, 849 or 860. However, some aid awarded to the college through a grant award may be recorded in Fund 145 and state allocated financial aid might be recorded in a state fund.

| Account | Funds | Debit | Credit |

|---|---|---|---|

| Fin Aid Exp | 846, 849, 850, Grant or State Fund | $1,500.00 | |

| Internal Cash | 846, 849, 850, Grant or State Fund | $1,500.00 |

For a simplified version of the process described above see Financial Aid Expenditure Accounting. For additional guidance submit a ticket to Accounting Support.

Under current GASB/NACUBO guidance, since the college is in control of paying student account balances and refunding the balance of the financial aid to the student, these expenditures are considered paid by the college. Therefore, the Second Journal Set is required to record the expenses.

Expenditure accounts for financial aid have been arranged in groups to easily identify the source of expenditure (see below).

For a detailed list of all financial aid expenditure accounts available, see Financial Aid Expenditure Accounts.

| Account Range Description* | Range Start | Range End |

|---|---|---|

| Scholarships and Fellowships | 5020000 | 5020499 |

| Federal | 5020030 | 5020119 |

| Pell | 5020030 | 5020035 |

| Fed Other | 5020036 | 5020119 |

| State | 5020120 | 5020229 |

| Local | 5020230 | 5020269 |

| Institutional | 5020270 | 5020329 |

| Institutional Restricted | 5020270 | 5020299 |

| Institutional Unrestricted | 5020300 | 5020329 |

| Not Reported to IPEDS | 5020330 | 5020369 |

| Student Loans | 5020370 | 5020409 |

*Aligns with IPEDS Part E Reporting

In ALL cases the financial aid expenditures should equal the total financial aid applied to the student account or refunded to the student (see Step 2 in section 50.50.40.2 Financial Aid Transactions above).

The community and technical colleges use Fund 846 (Grants In Aid) to record all student financial assistance, Fund 849 to record student loans and Fund 850 for Work Study awards. Occasionally financial aid expenditures are tracked in Fund 145 or when allocated to the college, expenditures will be recorded in a state fund (001, 08A, etc.).

Financial aid recorded in Funds 846, 849 or 850 should use one of the following class codes:

| Class | Description/Use |

|---|---|

| 271 | Scholarships |

| 272 | Loans |

| 273 | Off-Campus CWS-Fed |

| 274 | Off-Campus CWS-State |

| 275 | Waivers |

| 276 | Nursing Loan |

| 277 | NDSL |

| 278 | NDSL |

| 279 | Institutional Financial Aid |

Department codes for each source of financial aid is determined by individual colleges.

To determine the correct amount to be billed to each granting agency for financial aid expenditures, colleges should use the guidance provided in CLAM 50.50.70 Student Financials-Financial Aid Reconciliation .

50.40 Student Accounts << 50.50 >> 50.50.60 Financial Aid Reconciliation