ctcLink Accounting Manual | 50.30 Student Financials Processes

50.30 Student Financials Processes

2024-08-05

While many aspects of ctcLink student financials activity is automated based upon the configuration (as described in 50.20), other aspects require additional steps either completed through customizations or user actions.

Due to state laws and governmental accounting guidance, colleges are required to separate tuition charges into multiple funds and classes:

- Operating Fees (Tuition) – Split three (3) ways:

- Institutional Financial Assistance (3.5%) locally retained in Fund 860 - Class 279.

- Technology Innovation funds recorded in Fund 561 - Appropriation Index Z61 - Class 288 and remitted to the State Treasurer. By state law the maximum portion is 3% of the Operating Fee. Currently, the State Board approved amount is 2%.

- Balance of Operating Fees locally retained must be recorded in Fund 149 - Class 509.

- Building Fees (Tuition) - Split two (2) ways:

- Institutional Financial Assistance (3.5%) locally retained in Fund 860 - Class 279.

- Balance of Building Fee (96.5%) funds should be recorded in Fund 060 - Appropriation Index Z60 - Class 289 and remitted to the State Treasurer. Building fee amount is established by the legislature.

- Services and Activities (Tuition) - Split two (2) ways:

- Institutional Financial Assistance (3.5%) locally retained in Fund 860 - Class 279.

- Services and Activities (S&A) Fee (96.5%) funds retained locally and recorded in Fund 522 – Class 264. Maximum amount is established by the legislature.

In addition, student fee charges (both mandatory and miscellaneous) are generally recorded in Fund 148 and 528 and may be split in several chartstrings.

State and GASB accounting rules require the payment to be recorded in the same chartstring as the original charge. In ctcLink, this is accomplished through several processes.

- Tuition and Fee charges are split into multiple item types (operating, building and S&A) for each type of student (resident, non-resident, international, non-resident with operating differential, baccalaureate resident, baccalaureate non-resident, etc.) as described above.

- Payment, financial aid and waiver item types have a design function to pick up the receivable chartstring from the original charge to the student account (See section 50.30.20 below).

- This functionality does not allow the payment itself to pick up the chartstring from the original charge for the cash entry. Therefore, a custom Fund Balancing process has been developed to ensure cash is recorded in the same chartstring as the receivable. (See section 50.30.30 below).

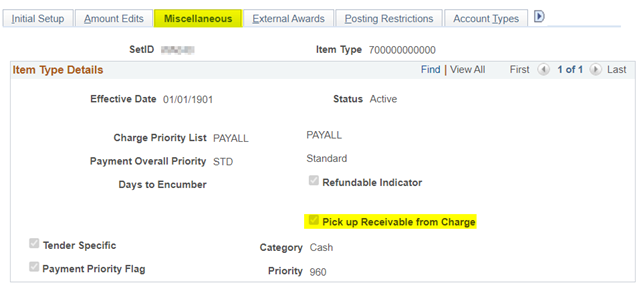

As noted in the Item Types section (CLAM 50.20), certain item types have the Pick Up Receivable From Charge (PURC) box checked. Each payment/financial aid/waiver item type should have the PURC box checked. When the box is checked, the item type does not use the chartstring in the item type configuration. Instead it uses the full chartstring from the original charge (receivable) and reduces the receivable account associated with the original charge.

Peoplesoft is not designed to split payments (cash payments/financial aid/waivers) into multiple chartstrings. A customization unique to ctcLink was created which:

a. Reverses the single line “WAxxx*LOCAL*7xxx*1000070 or 1000199*790**285*98009****N****”

or for waivers

“WAxxx*LOCAL*7xxx*40001xx*846**275*98299****N****” debit line with an equal credit

amount.

b. Creates new cash/waiver debit lines using the original account and the remaining chartstring from the receivable line created by PURC.

Fund balancing lines can be identified in the SF Accounting Line table begin with “10” inserted before the original line number. For example, if the original payment line number is ‘37385’ the related fund balancing line will be ‘10037385’.

Due to the use of PURC and Fund Balancing payment item types should be configured as shown below.

All cash/credit payment item types (7*) (cash/check/eCheck/credit card/EFT/wire) should be configured:

| Dr/Cr | Bus Unit | Ledger | Oper Unit | Account | Fund | Class Code | Dept | State Purpose |

|---|---|---|---|---|---|---|---|---|

| Dr | WAxxx | LOCAL | 7xxx | 1000070 | 790 | 285 | 98009 | N |

| Cr | WAxxx | LOCAL | 7xxx | 2000030 | 790 | 285 | 98009 | N |

Where the debit account is determined by the bank account (1000070-1000160) used for deposit.

All financial aid item types (9*) should be configured:

| Dr/Cr | Bus Unit | Ledger | Oper Unit | Account | Fund | Class Code | Dept | State Purpose |

|---|---|---|---|---|---|---|---|---|

| Dr | WAxxx | LOCAL | 7xxx | 1000199 | 790 | 285 | 98009 | N |

| Cr | WAxxx | LOCAL | 7xxx | 2000030 | 790 | 285 | 98009 | N |

All waiver item types (60*) should be configured:

| Dr/Cr | Bus Unit | Ledger | Oper Unit | Account | Fund | Class Code | Dept | State Purpose |

|---|---|---|---|---|---|---|---|---|

| Dr | WAxxx | LOCAL | 7xxx | 40001xx | 846 | 275 | 98299 | N |

| Cr | WAxxx | LOCAL | 7xxx | 4000199 | 790 | 285 | 98299 | N |

Where the debit account (4000100-4000190) is determined by the waiver type.

All payment plan item types (68*) be configured:

| Dr/Cr | Bus Unit | Ledger | Oper Unit | Account | Fund | Class Code | Dept | State Purpose |

|---|---|---|---|---|---|---|---|---|

| Dr | WAxxx | LOCAL | 7xxx | 1000199 | 790 | 285 | 98009 | N |

| Cr | WAxxx | LOCAL | 7xxx | 1011105 | 790 | 285 | 98009 | N |

All third-party payment item types (62*) should be configured:

| Dr/Cr | Bus Unit | Ledger | Oper Unit | Account | Fund | Class Code | Dept | State Purpose |

|---|---|---|---|---|---|---|---|---|

| Dr | WAxxx | LOCAL | 7xxx | 1000199 | 790 | 285 | 98009 | N |

| Cr | WAxxx | LOCAL | 7xxx | 1010220 | 790 | 285 | 98009 | N |

This example demonstrates the entire process from charges to payments including PURC and Fund Balancing.

Accounting Steps

- Operating Fees (Tuition) – Fund 149 with additional split into funds 860 (Institutional Financial Aid) and 561 (Innovation).

- Building Fees (Tuition) – Fund 060 with additional split into fund 860 (Institutional Financial Aid).

- Services and Activities Fees (Tuition) – Fund 522 with additional split into fund 860 (Institutional Financial Aid).

- Mandatory (Dedicated Fees) – Fund 148 with possible splits between class codes and departments depending on the type of course. It is also likely colleges may charge additional fees based on student usage (parking, etc.) which likely require splitting between additional class codes and departments.

- Cash Payment – In this example a simple cash payment for the full amount due is used.

The payment debit (cash) is always recorded in Fund 790-285-98009. The payment item

type must have the Pick Up Receivable from Charge box checked, therefore the credit

(relieving the receivable) will always use the chartstring from the original charges

in steps 1, 2, 3 and 4.

Since government accounting requires each fund to be balanced, recording the cash in Fund 790 and the relief of the receivable in other funds, this transaction will cause an error when sent to the general ledger. Therefore, the next step: - Fund Balancing – The cash entry to 790-285-98009 is reversed and distributed based upon the receivables being relieved. For additional discussion see section 50.30.30.

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept | |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | 1,099.33 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx (Operating) | 1 | Receivable | 1011010 | 41.151 | 860 | 279 | ddddd | |||

| 1 | Receivable | 1011010 | 35.27 | 561 | Z61 | 288 | ddddd | |||

| 1 | Revenue | 4000020 | (1,099.33) | 149 | 509 | ddddd | ||||

| 1 | Revenue | 4000020 | (41.15) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (35.27) | 561 | Z61 | 288 | ddddd | |||

| 1xxxxxxxxxxx (Building) | 2 | Receivable | 1011010 | 146.87 | 060 | Z60 | 289 | ddddd | ||

| 2 | Receivable | 1011010 | 5.331 | 860 | 279 | ddddd | ||||

| 2 | Revenue | 4000020 | (146.87) | 060 | Z60 | 289 | ddddd | |||

| 2 | Revenue | 4000020 | (5.33) | 860 | 279 | ddddd | ||||

| 1xxxxxxxxxxx (S&A) | 3 | Receivable | 1011010 | 152.52 | 522 | 264 | ddddd | |||

| 3 | Receivable | 1011010 | 5.531 | 860 | 279 | ddddd | ||||

| 3 | Revenue | 4000020 | (152.52) | 522 | 264 | ddddd | ||||

| 3 | Revenue | 4000020 | (5.53) | 860 | 279 | ddddd | ||||

| 2xxxxxxxxxxx (Fees) | 4 | Receivable | 1011010 | 150.00 | 148 | 011 | ddddd | |||

| 4 | Revenue | 4000020 | (150.00) | 148 | 011 | ddddd | ||||

| Total | 1,636.00 | (1,636.00) | ||||||||

Cash Payment

**Pick Up Receivable From Charge (PURC) Box Checked

| Item Type | DR/CR | Fund | Class | Dept | Account | Amount |

|---|---|---|---|---|---|---|

| 700000000000 | DR | 790 | 285 | 98009 | 1000070 | $1,636.00 |

| CR | 790 | 285 | 98009 | 2000030 |

Cash Payment

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 5 | Cash | 1000070 | 1,636.00 | 790 | 285 | 98009 | |||

| 700000000000 (Cash) Line="nnnnn"Eg "37385" |

5 | Receivable | 1011010 | (1,099.33) | 149 | 509 | ddddd | |||

| 5 | Receivable | 1011010 | (52.01)1 | 860 | 279 | ddddd | ||||

| 5 | Receivable | 1011010 | (35.27) | 561 | Z61 | 288 | ddddd | |||

| 5 | Receivable | 1011010 | (146.87) | 060 | Z60 | 289 | ddddd | |||

| 5 | Receivable | 1011010 | (152.52) | 522 | 264 | ddddd | ||||

| 5 | Receivable | 1011010 | (150.00) | 148 | 011 | ddddd | ||||

| Total | 1,636.00 | (1,636.00) | ||||||||

1 Credit receivable amount is the combined amount from the operating, building and S&A dedicated to Institutional Financial Aid.

Cash Fund Balance

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund Bal | 6 | Cash | 1000070 | 1,099.33 | 149 | 509 | ddddd | |||

| CEMLI E-214Line="100nnnnn"Eg "10037385" | 6 | Cash | 1000070 | 52.01 | 860 | 279 | ddddd | |||

| 6 | Cash | 1000070 | 35.27 | 561 | Z61 | 288 | ddddd | |||

| 6 | Cash | 1000070 | 146.87 | 060 | Z60 | 289 | ddddd | |||

| 6 | Cash | 1000070 | 152.52 | 522 | 264 | ddddd | ||||

| 6 | Cash | 1000070 | 150.00 | 148 | 011 | ddddd | ||||

| 6 | Cash | 1000070 | (1,636.00) | 790 | 285 | 98009 | ||||

| Total | 1,636.00 | (1,636.00) | ||||||||

50.30.50 Financial Aid Second Journal Set (CEMLI E-218)

When financial aid is applied to a student account to pay off charges the item type uses Pick Up Receivable from Charge and Fund Balancing to ensure the receivables are relieved and cash is recorded in the same chartstring as the original charges (receivable/revenue). The item type uses Internal Cash (1000199) because the transaction will not result in a change to the college’s bank cash.

Since the college internally paid the student charges on behalf of the student, the college must record the expense in an appropriate fund. And because the financial aid item type uses the internal cash account an offset of an equal amount of internal cash must be recorded in the accounting records (since internal cash must always net to zero).

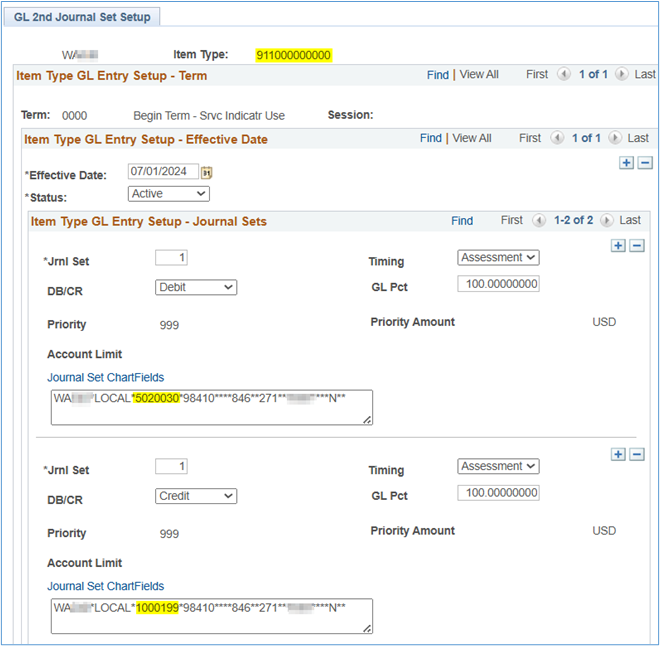

To record this entry, a customized process was created to record the expense and internal cash. The college must create a 2nd Journal Set (SJS) for each financial aid item type to record the expense and internal cash. See 50.30.50.2 below.

The process identifies all payments made using each 2nd Journal Set item type to create a debit expense (account determined by funding source and type) and credit internal cash (always 1000199) transactions.

Overnight a job is run to create an SJS journal (separate from the SF Accounting Line table) with all the detailed financial aid applied to student accounts including Item Type and Student ID. These transactions are summarized and posted to the General Ledger using Source and Journal ID prefix ‘SJS’.

For example, the SJS journal in SF consisted of 394 lines but the summarized version of this journal in FIN is only 10 lines.

To access the setup screen: Menu > Set Up SACR > Product Related > Student Financials > GL 2nd Journal Set Setup. However, the ability to create or modify SJS is limited to State Board staff therefore a ticket must be submitted to add or make changes to a SJS Item Type. See also the ctcLink Reference Center.

Below is an example of SJS setup using Pell Grants.

The credit account is ALWAYS 1000199 (Internal Cash) and the debit must be an expenditure account from the Second Journal Set Financial Aid Expenditure Accounts list.

The following queries should be helpful in ensuring all required financial aid item types have a Second Journal Set and to review SJS transactions:

| Query Name | Description |

|---|---|

| QCS_SF_2ND_JOURNAL_SET | GL 2nd Journal Set Setup |

| QCS_SF_ITEM_SJS_VAL | SJS Item Type Validation |

| QCS_SF_ITEM_1ST_2ND_ACCTS | Item Type GL 1st & 2nd |

Returns Item Types (with and without an SJS). Option to look up specific Item Type or description.

| Query Name | Description |

|---|---|

| QCS_SF_ACCTNG_LN_W_PROMPTS_SJS | Student Financials SJS |

| QCS_SF_ACCTNG_LN_SJS | Stdnt Financials Trans SJS |

50.30.50.3.a Second Journal Set List

To generate a list of all SJS Item Types (active and inactive) by college run the query ‘QCS_SF_2ND_JOURNAL_SET’. The query returns the following fields and values (the table has been transposed to allow easier display):

| Item Type Debit | Item Type Credit | Item Type Debit | Item Type Credit | |

|---|---|---|---|---|

| SetID | WAxxx | WAxxx | WAxxx | WAxxx |

| Item Type | 911000000000 | 911000000000 | 912000000400 | 912000000400 |

| Descr | Federal Pell Grant | Federal Pell Grant | BFET Tuition | BFET Tuition |

| Eff Date | 7/1/2019 | 7/1/2019 | 7/1/2023 | 7/1/2023 |

| Status | A | A | A | A |

| DB/CR | D | C | D | C |

| Unit | WAxxx | WAxxx | WAxxx | WAxxx |

| Ledger | LOCAL | LOCAL | LOCAL | LOCAL |

| Acct | 5020030 | 1000199 | 5020080 | 1000199 |

| DeptID | ddddd | ddddd | ddddd | ddddd |

| Proj/Grt | 0000009526 | 0000009526 | ||

| ActivityID | TUIT | TUIT | ||

| Fund | 846 | 846 | 146 | 146 |

| Approp Index | ||||

| Class | 271 | 271 | 161 | 161 |

| Operating Unit | 7xxx | 7xxx | 7xxx | 7xxx |

| Chartfield2 | N | N | N | N |

50.30.50.3.b Second Journal Set Item Type Validation

To determine if any Item Types that should have a SJS do, run the QCS_SF_ITEM_SJS_VAL query. This query returns the original Item Type with chartfields and the SJS Item Type with chartfields in the same row (if a SJS exists).

| 'First' Journal Set | Debit Line | Credit Line |

|---|---|---|

| SetID | WAxxx | WAxxx |

| Item Type | 911000000000 | 911000000000 |

| Descr | Federal Pell Grant | Federal Pell Grant |

| DB/CR | D | C |

| Unit | WAxxx | WAxxx |

| Ledger | LOCAL | LOCAL |

| Acct | 1000199 | 2000030 |

| DeptID | 98009 | 98009 |

| Alloc | ||

| Fund | 790 | 790 |

| Class | 285 | 285 |

| Operating Unit | 7xxx | 7xxx |

| Chartfield1 | ||

| Chartfield2 | N | N |

| GL Pct | 100.00000000 | 100.00000000 |

| 'Second' Journal Set | ||

| Item Type | 911000000000 | 911000000000 |

| 2nd Jrnl DB/CR | D | C |

| 2nd Jrnl Unit | WAxxx | WAxxx |

| 2nd Jrnl Ledger | LOCAL | LOCAL |

| 2nd Jrnl Acct | 5020030 | 1000199 |

| 2nd Jrnl DeptID | ddddd | ddddd |

| 2nd Jrnl Prod | ||

| 2nd Jrnl Fund | 846 | 846 |

| 2nd Jrnl Class | 271 | 271 |

| 2nd Jrnl Operating Unit | 7xxx | 7xxx |

| 2nd Jrnl Chartfield1 | ||

| 2nd Jrnl Chartfield2 | N | N |

| 2nd Jrnl GL Pct | 100.00000000 | 100.00000000 |

50.30.50.3.c All Item Types with 1st and 2nd Journal Sets

The QCS_SF_ITEM_1ST_2ND_ACCOUNTS query is similar to the QCS_SF_ITEM_SJS_VAL query but returns ALL item types displaying the SJS (the SJS fields are blank if a SJS has not been set up for this item type).

50.30.50.3.d SJS SF Accounting Line

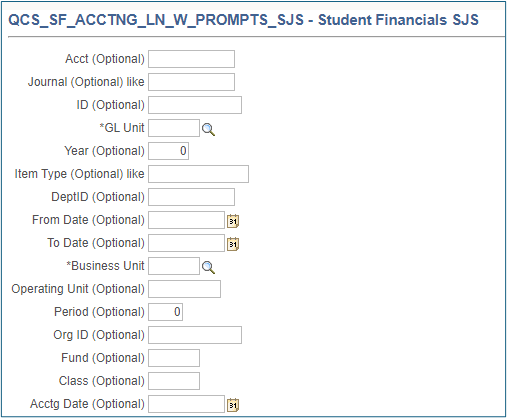

The QCS_SF_ACCTNG_LN_W_PROMPTS_SJS query provides multiple options in selecting the records desired with only GL Unit (District - WAxxx) and Business Unit (College – WAxxx for multi-college districts) required.

The query returns the following fields and values:

| Field Name | Field Value Internal Cash | Field Value Expenditure | Description |

|---|---|---|---|

| Run Date | 4/8/2024 | 4/8/2024 | Date journal generator run. |

| SeqNum | 316 | 316 | System Assigned |

| Line | 1 | 2 | Line number |

| ID | 2xxxxxxxx | 2xxxxxxxx | Student ID |

| Item Type | 911000000000 | 911000000000 | Item Type Number |

| Item Term | 2243 | 2243 | Fin Aid Term |

| Student Line Amt | (2,465.00) | 2,465.00 | Fin Aid Amount Dr(Cr) By Account |

| GL Amount (duplicated) | (27,865.00) | 27,865.00 | Total amount by Journal, Item Type and Account |

| In Process | N | N | |

| GL Unit | WAxxx | WAxxx | District Business Unit |

| Journal | SJS0442572 | SJS0442572 | Journal ID. Equals Journal ID in GL. |

| Date | 4/8/2024 | 4/8/2024 | Date journal created |

| Line # | 1 | 2 | Line number |

| Acct | 1000199 | 5020030 | Account. For Financial Aid only internal cash (1000199) and expense (502xxx) should be used. |

| Fund | 846 | 846 | Fund |

| Program | College specific value | ||

| DeptID | 81200 | 81200 | College specific value |

| AnlysType | DNC | GLE | Analysis Type used if project set up for financial aid. |

| ActivityID | Used when financial aid tracked using a project. | ||

| PC Bus Unit | Used when financial aid tracked using a project. | ||

| Proj/Grt | Used when financial aid tracked using a project. | ||

| Stat | N/A | ||

| Stat Amt | 0.00 | 0.00 | N/A |

| Reference | N/A | ||

| Status | N/A | ||

| Line Descr | 911000000000 | 911000000000 | Item Type Number transferred to GL Journal. Allows for easy identification of financial aid source in GL. |

| Status | N/A | ||

| Line Date | N/A | ||

| Unit | WAxxx | WAxxx | College Business Unit. This value equals the GL Unit except for multi-college districts. |

| Template | CTCSASFDFN | CTCSASFDFN | Used by system to create correct journal detail |

| Acctg Date | 4/8/2024 | 4/8/2024 | Date journal posted to FIN GL |

| Status | D | D | D=Distributed |

| Instance | 156758486 | 156758486 | System Identifier |

| Currency | N/A | ||

| Period | 10 | 10 | Accounting Period |

| Year | 2024 | 2024 | Fiscal Year |

| Amount | 0.00 | 0.00 | Net amount. This should always be 0.00 since debits and credits must be equal. |

| Currency | N/A | ||

| Ledger | LOCAL | LOCAL | Ledger journal to be posted |

| Ledger Grp | N/A | ||

| Ext Chart | N/A | ||

| ID | N/A | ||

| Org ID | N/A | ||

| Item Nbr | N/A | ||

| Bgt Pd. | N/A | ||

| Class | 271 | 271 | Class Code as defined in SJS setup. |

| Affl | N/A | ||

| Budget Ref | N/A | ||

| Chartfield1 | N/A | ||

| Chartfield2 | N | N | State Purpose IT - Always 'N' for Fin Aid |

| Chartfield3 | N/A | ||

| Alt. Account | N/A | ||

| Operating Unit | 7xxx | 7xxx | Operating Unit (should be associated with Unit) |

| Prod | Appropriation Index if state funds. | ||

| Fund Affil | N/A | ||

| Oper Unit Affil | N/A | ||

| Deposit | N/A | ||

| Rate Type | N/A | ||

| Divisor | 0.00000000 | 0.00000000 | N/A |

| Multiplier | 0.00000000 | 0.00000000 | N/A |

| Instance | 0 | 0 | N/A |

| Action | C | C | N/A |

| ID | N/A | ||

| ID Type | N/A | ||

| GL Transac ID | N/A | ||

| GL Trans Ln Seq | 0 | 0 | N/A |

| Item Term | N/A | ||

| Item Type | N/A | ||

| Ref Nbr | N/A | ||

| Receipt Num | 0 | 0 | N/A |

| Created By | N/A | ||

| Created | N/A | ||

| By | N/A | ||

| Updated | N/A |

Colleges should reconcile the SF, GL and SJS transactions frequently - daily if possible but no less than weekly.

Ways Internal Cash (1000199) can get out of balance:

- Manual journals with unbalanced internal cash amounts (1000199 credits <> debits).

- 32* and 62* - Third-Party Payments (recording the 32* Item Type but not recording the 62* Item Type)

- 38* and 68* - Payment Plans (recording the 38* Item Type but not recording the 68* Item Type)

- FARC/FARP – 496100000000 and 709610000000 (recording the 4961* Item Type but not recording the 70961* Item Type)

- Conversion item types (e.g. Conv: FA Refund, Conv: FA Adjust). Not all conversion item types were configured to balance internal cash.

- Missing or incorrect chart strings from SF item types

- Missing or incorrect chart stings from SJS item types

Colleges should use one of the E214 queries to compare with the results of one the daily SJS journal queries:

| Recommended E214 Queries | Recommended SJS Queries |

|---|---|

| QCS_SF_E214_ACCTG_LN | QCS_SF_ACCTNG_LN_W_PROMPTS_SJS |

| QCS_SF_E214_ACCTG_LN_CF_DTL | QCS_SF_ACCTNG_LN_SJS |

| QCS_SF_E214_ACCTG__CF_SUMM | |

| CTC_SF_ACCTNG_LN_WITH_PROMPTS |

For additional information see Internal Cash Reconciliation Tips PowerPoint presentation.

50.30.60 Student Financial Process Scenarios

Self-payment is relatively straightforward and includes fund balancing to ensure payment (cash) is recorded in the same chartstring as the charges/receivables since this item type Picks Up Receivable from Charge.

In the example below, the student’s payment did not exceed the amount owed so ‘Unapplied Student Liability’ (2000030) is not recorded. If the student’s payment had exceeded the amount owed, the liability would be recorded and an unapplied amount would remain on the student account until a refund was issued.

- Original tuition charges

- Pay off original charges with cash/credit using cash in bank (1000070)

- Cash payment fund balanced to original receivable chartstring

Charge

| Event | Step | Action | Account | Account2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | 261 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Chrg-Rev | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Chrg-Rev | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Chrg-Rev | 4000020 | (3.00) | 561 | 261 | 288 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 2 | Payment | 1000070 | $100.00 | 790 | 285 | 98009 | |||

| Line no = | 2 | Pmt-Rec | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| "nnnnn" | 2 | Pmt-Rec | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| Eg. "37385" | 2 | Pmt-Rec | 1011010 | (3.00) | 561 | 261 | 288 | ddddd |

Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Fund Bal | 1000070 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 1000070 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 1000070 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000070 | $(100.00) | 790 | 285 | 98009 |

Both financial aid and internal aid item types require a Second Journal Set.

The application of financial aid is recorded as a payment and includes fund balancing to ensure payment (internal cash) is recorded in the same chartstring as the charges/receivables since this item type Picks Up Receivable from Charge (PURC).

In the example below, the financial aid payment exceeds the amount owed so ‘Unapplied Student Liability’ (2000030) is recorded.

- Original tuition charges.

- Pay off original charges with financial aid and internal cash (1000199). Unapplied amount is recorded as Student Liability. This is refunded to the student either via BankMobile or a check issued to the student (see Section 50.30.60.3 below)

- Internal cash payment fund balanced to original receivable chartstring.

- 2nd Journal Set is used to record the expenditure and internal cash in Fund 846, Class 271 and department based on source and type of financial aid.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Rec | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Rec | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Rec | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (3.00) | 561 | Z61 | 288 | ddddd |

FA Applied

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| FA Applied | 2 | Pmt-Cash | 1000199 | $200.00 | 790 | 285 | 98009 | |||

| 9xxxxxxxxxxx | 2 | Pmt-Rec | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| Line no = | 2 | Pmt-Rec | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| “nnnnn” | 2 | Pmt-Rec | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd | ||

| Eg:”37385” | 2 | Pmt-Liab | 1011010 | (100.00) | 790 | 285 | 98009 |

CEMLI E214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E214 | 3 | Fund Bal | 1000199 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 1000199 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 1000199 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000199 | 100.00 | 790 | 285 | 98009 | |||

| 3 | Fund Bal | 1000199 | $(200.00) | 790 | 285 | 98009 |

Custom Second Journal Set

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| SJS Journal | 4 | 2nd Jrnl Set | 5020xxx | $200.00 | 846 | 271 | ddddd | |||

| SJS Journal | 4 | 2nd Jrnl Set | 1000199 | $(200.00) | 846 | 271 | ddddd |

Much like financial aid, departmental/internal payment (and may be financial aid, depending on the funding source) is recorded as a payment and includes fund balancing to ensure payment (internal cash) is recorded in the same chartstring as the charges/receivables since this item type Picks Up Receivable from Charge (PURC).

In most circumstances, departmental/internal payments (IP) do not exceed the amount owed so ‘Unapplied Student Liability’ (2000030) is normally not recorded.

- Original charges.

- Pay off original charges with departmental/internal aid and internal cash (1000199). Excess payment amounts are recorded as Unapplied Student Liability. If the internal payment Item Type is configured as being refundable, then the unapplied amount is refunded to the student either via BankMobile or a check issued to the student (see Section 50.30.60.3 below)

- Departmental/Internal cash payment fund balanced to original receivable chartstring.

- 2nd Journal Set Journal is used to record the expenditure and internal cash in Fund ‘fff’, Class ‘ccc’ and Dept ‘ddddd’ based on source and type of funding used.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| 1xxxxxxxxxxx | 1 | Receivable | 1011020 | $75.00 | 148 | 042 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011020 | $25.00 | 148 | 041 | ddddd | |||

| 3xxxxxxxxxxx | 1 | Revenue | 4000050 | $(75.00) | 148 | 042 | ddddd | |||

| 1 | Revenue | 4000060 | $(25.00) | 148 | 041 | ddddd |

Department/Internal Payment Applied

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| IP Applied | 2 | Payment | 1000199 | $100.00 | 790 | 285 | 98009 | |||

| 75xxxxxxxxxx | 2 | Pmt-Rec | 1011020 | $(75.00) | 148 | 042 | ddddd | |||

| Line no = | 2 | Pmt-Rec | 1011020 | (25.00) | 148 | 041 | ddddd | |||

| “nnnnn” | ||||||||||

| Eg:”37385” |

CEMLI E214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | FundBal | 1000199 | $75.00 | 042 | ddddd | ||||

| Line no = | 3 | FundBal | 1000199 | 25.00 | 041 | ddddd | ||||

| “10nnnnn” | 3 | FundBal | 1000199 | $(100.00) | 285 | 98009 | ||||

| Eg:”1037385” |

Custom Second Journal Set

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| SJS Journal | 4 | 2nd Jrnl Set | 5020xxx | $100.00 | fff | ccc | ddddd | |||

| 4 | 1000199 | $(100.00) | fff | ccc | ddddd |

Student refunds are nearly identical for student self-pay or financial aid. Cash payments are usually refunded with a check, credit card payments may be refunded either by check or returned to the credit card.

To initiate the student refund check, student financials staff must apply a check refund item type (5900000000xx) to the student account. This will send the liability to Accounts Payable using account 2000015.

For an electronic refund, student services should apply either a credit card or BankMobile refund item. Then, either cashiering or finance staff must process the refund to the student credit card or submit an EFT to Bank Mobile, depending on the fund type See Step 5d below).

In the example below, the financial aid payment exceeds the amount owed so ‘Unapplied Student Liability’ (2000030) is recorded.

- 5a – When a refund item type is applied to the student account, ctcLink will credit the Unapplied Student Liability (2000030) and debit the liability account (2000015) recorded in the AP Chartfield portion of the Refund Item Type configuration (The use of 2000015 enables the college to determine which AP entries originated in Student Financials vs Finance).

- 5b – The AP Chartfield is sent to Accounts Payable in Finance to create a voucher for payment. This process converts the SF liability account to an AP liability account (2000010).

- 5c – When the check is issued AP relieves the AP liability account and credits cash.

- 5d – Electronic payments using Bank Mobile, credit card, EFT or wire funds are initiated when student services applies an EFT Item Type (590000000xxx) to the student account. Different Item Types are used to initiate the refund allowing colleges to track each refund type.

Since these refunds are processed directly with the bank, they are not sent to Accounts Payable. Instead the Unapplied Student Liability account is debited and cash in bank is credited.

Student Check Refund

Send to GL

| Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| 5a | Refund | 2000030 | $100.00 | 790 | 285 | ddddd | |||

| 5a | Refund | 2000015 | $(100.00) | 790 | 285 | ddddd |

Voucher Created

Step 5b and 5c occur in the Accounts Payable module in Finance.

| Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| 5b | Voucher | 2000015 | $100.00 | 790 | 285 | ddddd | |||

| 5b | Voucher | 2000010 | $(100.00) | 790 | 285 | ddddd |

Student Electronic Fund

Check Issued

| Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| 5c | Payment | 2000010 | $100.00 | 790 | 285 | ddddd | |||

| 5c | Payment | 1000070 | $(100.00) | 790 | 285 | ddddd |

Or

EFT-Initiated Event

| Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| 5d | Refund | 2000030 | $100.00 | 790 | 285 | ddddd | |||

| 5d | Refund | 1000070 | $(100.00) | 790 | 285 | ddddd |

Financial Aid staff adjust award based on student’s discontinuation of attendance based on federal, state and college rules for refunding.

When the adjustment is applied, it generates an entry on the student account using the item type associated with the financial aid source. For example, Pell:

Award Adjustment is applied (i.e. negative payment) using the original item type (9xxxxxxxxxxx):

- Cr Internal Cash (1000199)

- Dr Receivable (Pick Up Receivable from Charge is used)

Second Journal reverses the original financial aid expense:

- Cr Expense (5020xxx)

- Dr Internal Cash (1000199)

Financial Aid Refund Adjust (payment) is applied using item type 709610000000

- Cr Receivable (Pick Up Receivable from Charge is used)

- Dr Internal Cash (1000199)

Financial Aid Adjustment Due (charge) is applied using item type 496100000000

- Cr Internal Cash (1000199)

- Dr Student R2T4 Loan Receivable (1011120)

College returns funds to the Department of Education (ED). This reverses the original revenue and cash received from ED.

The application of financial aid is recorded as a payment and includes fund balancing to ensure payment (internal cash) is recorded in the same chartstring as the charges/receivables since this item type Picks Up Receivable from Charge (PURC).

In the example below, the financial aid payment exceeds the amount owed so an ‘Unapplied Student Liability’ (2000030) is recorded.

- Original tuition charges.

- Pay off original charges with financial aid and internal cash (1000199). Unapplied amount is recorded as a Student Liability. This is refunded to the student either via BankMobile or a check issued to the student (see Section 50.30.60.3 above).

- Internal cash payment fund balanced to original receivable chartstring.

- 2nd Journal Set is used to record the expenditure and internal cash in Fund 846, Class 271 and department based on source and type of financial aid.

- When the adjustment to financial aid is applied to the student account by financial aid staff, an entry is generated in which the original award item type transaction is reversed in the amount of the adjustment. Assuming the student had not earned any of the refund and was not eligible for tuition reimbursement.

- 2nd Journal Set is used to record the reversal of expenditure and internal cash in Fund 846, Class 271 and department based on source and type of financial aid.

- Charges are removed (paid) using the payment Item Type 70961xxxxxxx. This item should only be used in conjunction with Item Type 49610xxxxxxx.

- New charges are applied recording a Student Loan Receivable and Internal Cash with Item Type 49610xxxxxxx.

- Student repayment is recorded reducing the receivable and increasing Cash In Bank.

- Although not required since it is a single chartstring, ctcLink will run the fund balancing process since fund balancing is triggered by any payment or waiver item type.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (3.00) | 561 | Z61 | 288 | ddddd |

FA Applied

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| FA Applied | 2 | Pmt-Cash | 1000199 | $200.00 | 790 | 285 | 98009 | |||

| 9xxxxxxxxxxx | 2 | Pmt-Rec | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| Line no = | 2 | Pmt-Rec | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| “nnnnn” | 2 | Pmt-Rec | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd | ||

| Eg:”37385” | 2 | Pmt-Liab | 2000030 | (100.00) | 790 | 285 | 98009 |

CEMLI E214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Int Cash | 1000199 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Int Cash | 1000199 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Int Cash | 1000199 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Int Cash | 1000199 | 100.00 | 790 | 285 | 98009 | |||

| 3 | Int Cash | 1000199 | $(200.00) | 790 | 285 | 98009 |

Custom Second Journal Set

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| SJS Journal | 4 | FA Exp | 5020xxx | $200.00 | 846 | 271 | ddddd | |||

| SJS Journal | 4 | Int Cash | 1000199 | $(200.00) | 846 | 271 | ddddd |

FA Adjusted

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| FA Adjusted | 5 | Pmt-Rec | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 9xxxxxxxxxxx | 5 | Pmt-Rec | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| Line no = | 5 | Pmt-Rec | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| “nnnnn” | 5 | Pmt-Liab | 2000030 | 100.00 | 790 | 285 | 98009 | |||

| Eg:”37385” | 5 | Pmt-Cash | 1000199 | $(200.00) | 790 | 285 | 98009 |

Custom Second Journal Set

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| SJS Journal | 6 | Int Cash | 1000199 | $200.00 | 846 | 271 | ddddd | |||

| SJS Journal | 6 | FA Exp | 5020xxx | $(200.00) | 846 | 271 | ddddd |

FA Refund Adjustment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Cashstring Fund | Cashstring AI | Cashstring Class | Cashstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| FA Rfnd Adj | 7 | Pmt-Cash | 1000199 | $200.00 | 790 | 285 | 98009 | |||

| 70961xxxxxxx | 7 | Pmt-Rec | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| Line no = | 7 | Pmt-Rec | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| “nnnnn” | 7 | Pmt-Rec | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd | ||

| Eg:”37385” | 7 | Pmt-Liab | 2000030 | (100.00) | 790 | 285 | 98009 |

FA Adjustment Due

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| FA Adj Due | 8 | Rec | 1011120 | $200.00 | 846 | 271 | ddddd | |||

| 49610000xxxx | 8 | Int Cash | 1000199 | $(200.00) | 846 | 271 | ddddd |

Student Repay

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Stdt Repay | 9 | Bnk Cash | 1000070 | $200.00 | 846 | 271 | ddddd | |||

| 7000xxxxxxxx | 9 | Rec | 1011120 | $(200.00) | 846 | 271 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 10 | Bnk Cash | 1000070 | $200.00 | 846 | 271 | ddddd | |||

| (Fund Bal) | 10 | Bnk Cash | 1000070 | $(200.00) | 846 | 271 | ddddd |

Waivers behave in a manner similar to payments in that the receivable is relieved but a debit to a contra-revenue is recorded instead of cash. Below is the list of waiver accounts:

| Account | Waiver Account Title |

|---|---|

| 4000100 | Tuition & Fee Waiver |

| 4000105 | Tuition & Fee Waiver-Need |

| 4000110 | Tuition & Fee Waiver-Non-Need |

| 4000115 | Tuition & Fee Waiver-Athletic |

| 4000118 | Tuition & Fee Waiver-Athletic Gender Equity |

The account used is determined by the Waiver Item Type configuration.

The fund balancing process records the contra-revenue into the chartstring where the original revenue is recorded.

Although the Item Type is configured using Fund 846 Class 275m the waiver is recorded in the chartstring of the original charges (receivable/revenue) due to PURC and Fund Balancing.

- Original tuition charges.

- Waiver reduces the receivable for waiver allowed amounts and records a contra-revenue.

- Waiver fund balanced to original receivable chartstring.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (3.00) | 561 | Z61 | 288 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 2 | Waiver | 40001xx | $100.00 | 790 | 285 | 98009 | |||

| Line no = | 2 | Receivable | 1011010 | ($93.50) | 149 | 509 | ddddd | |||

| “nnnnn” | 2 | Receivable | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| Eg:”37385” | 2 | Receivable | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Fund Bal | 40001xx | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 40001xx | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 40001xx | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000199 | $(100.00) | 790 | 285 | 98809 |

Some colleges have elected to offer payment plans to students. The payment plans could be managed by the college or Nelnet. This allows students to make weekly/monthly payments instead of paying the entire amount at the beginning of the term.

Moving students to a payment plan is a 2-step process in which all the charges (operating, building, S&A and fees) are ‘paid off’ and a new single payment plan charge is applied.

- Original tuition charges.

- Pay off original charges with payment plan item type (680000000xxx) using internal cash (1000199). Since this is a payment item type, it should use 2000030 Student Liability ST as the credit (for any unapplied amounts, which is rare).

- Payment Plan payment fund balanced to original receivable chartstring.

- Payment plan charges applied (380000000xxx) to student account with payment plan receivable (1011100) and internal cash (1000199).

- Payment made by student relieving receivable (directly for college payment plans or a Nelnet payment) for 1/3 of the outstanding balance.

- Cash payment is fund balanced to receivable chartstring.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | 3.50 | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | 3.00 | 561 | Z61 | 288 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 2 | Int Cash | 1000199 | $100.00 | 790 | 285 | 98009 | |||

| Item type = | 2 | Receivable | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| 680000000xxx | 2 | Receivable | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| 2 | Receivable | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Fund Bal | 1000199 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 1000199 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 1000199 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000199 | $(100.00) | 790 | 285 | 98009 |

Recharge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Recharge | 4 | Receivable | 1011100 | $100.00 | 849 | 272 | ddddd | |||

| 380000000xxx | 4 | Int Cash | 1000199 | $(100.00) | 849 | 272 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 5 | Pmt Cash | 1000070 | $33.34 | 790 | 285 | 98009 | |||

| 7000000xxxxx | 5 | Receivable | 1011100 | $(33.34) | 849 | 272 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 6 | Fund Bal | 1000070 | $33.34 | 849 | 272 | ddddd | |||

| See above | 6 | Fund Bal | 1000070 | $(33.34) | 790 | 285 | 98009 |

Collection agreements work in a manner similar to payment plans.

Moving students to collections is a 2-step process in which all the charges (operating, building, S&A and fees) are ‘paid off’ and a new single collections charge is applied.

- Original tuition charges with fund balancing

- Pay off original charges with collection agreement item type (690000000xxx) using internal cash (1000199). Since this is a payment item type, it should use 2000030 Student Liability ST as the credit (for any unapplied amounts, which is rare).

- Collection agreement payment fund balanced to original receivable chartstring.

- Collection agreement charges applied (390000000xxx) to student account with collections receivable (1010070) and internal cash (1000199).

- Payment made by collection agency relieving receivable.

- Cash payment is fund balanced to receivable chartstring.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (3.00) | 561 | Z61 | 288 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 2 | Int Cash | 1000199 | $100.00 | 790 | 285 | 98009 | |||

| Item type = | 2 | Receivable | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| 690000000xxx | 2 | Receivable | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| 2 | Receivable | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Fund Bal | 1000199 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 1000199 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 1000199 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000199 | $(100.00) | 790 | 285 | 98009 |

Recharge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Recharge | 4 | Receivable | 1011100 | $100.00 | 849 | 272 | ddddd | |||

| 390000000xxx | 4 | Int Cash | 1000199 | $(100.00) | 849 | 272 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 5 | Pmt-Cash | 1000070 | $33.34 | 790 | 285 | 98009 | |||

| 7000000xxxxx | 5 | Receivable | 1011100 | $(33.34) | 849 | 272 | ddddd |

CEMLI E-214 - Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 6 | Fund Bal | 1000070 | $33.34 | 849 | 272 | ddddd | |||

| See above | 6 | Fund Bal | 1000070 | $(33.34) | 790 | 285 | 98009 |

A write-off is the elimination of uncollectible accounts receivable in the college accounting records. An accounts receivable balance represents an amount due to the college. If the individual/entity is unable to fulfill the obligation, the outstanding balance should be written off after collection attempts have occurred.

This does not mean the student no longer owes the debt. The debt is removed from the college’s account receivables, but if the individual/entity wishes to use the college services in the future, the written-off accounts receivable should be restored.

College staff must be aware of all legal limitations and/or requirements for providing or refusing to provide services to individuals/entities with uncollected receivables.

The write-off of uncollectable receivables must be subject to management review using procedures developed by the college in cooperation with the Attorney General’s Office.

50.30.60.8.a Non-Dischargeable Student Debt

Student educational debt is not dischargeable under any of the bankruptcy laws (Chapter 7, 11 or 13). These include:

- An educational benefit overpayment or loan made, insured, or guaranteed by a government agency or made under any program funded by a government or nonprofit agency.

- Obligation to repay funds received as an educational benefit, scholarship, or stipend.

- A qualified “educational loan” under the Internal Revenue Code means:

- Debt incurred solely to pay “qualified higher education expenses” for taxpayer or taxpayer’s spouse or dependent.

- Qualified expenses mean cost of attendance at Title IV eligible institution.

- Covers “alternative” or “supplemental” loans, regardless of funding source.

- Any amount overpaid, such as payment of “educational benefits” for period in which student is not enrolled (e.g. GI Bill benefits, tuition waivers, grant, work study overpayments or benefits funded by a nonprofit like a college foundation).

Educational loan definition

An educational loan is defined as an advancement of funds, credit, or financial accommodations under a contemporaneous, mutual understanding of future repayment. College must quantify and create an obligation to repay the value of the educational benefit actually received, whether or not funds are in fact advanced to the student.

- Debt incurred solely to pay “qualified higher education expenses” for taxpayer or taxpayer’s spouse or dependent.

- Qualified expenses mean the cost of attendance at Title IV eligible institution.

- Covers “alternative” or “supplemental” loans, regardless of funding source.

Educational benefit definition

An educational benefit is defined as any funds received as an educational benefit, including a scholarship or stipend, regardless of funding source. Requires an obligation to repay funds actually received for an educational purpose (e.g. Obligation to refund a scholarship upon early academic withdrawal).

50.30.60.8.b Non-Dischargeable Student Debt Undue Hardship

Nondischargeable student debt can only be discharged based on “undue hardship.”

Debtor must file separate adversary proceedings (requires summons and complaint).

Parents incurring nondischargeable debt for student’s education can also claim undue hardship.

Parents filing for bankruptcy may claim “clawback” of “preferential” tuition payments.

50.30.60.8.c Dischargeable Student Debt Under Bankruptcy

The only debt dischargeable under normal bankruptcy are:

- Unpaid tuition account

- Housing and dining charges

- Mandatory student fees

- Childcare fees

- Parking fees

- Bookstore charge

50.30.60.8.d Legal Advice

Most of the content in this section was adapted from the 2018 presentation by the Washington State Attorney General’s office: The College as Creditor

Colleges should contact their Assistant Attorney General for additional advice.

50.30.60.8.e Accounting for Tuition/Student Account Write-Offs

Prior to writing off student accounts the college should ensure a sufficient balance exists (by fund) in the Allow-Uncollect AR ST (1010110) account as instructed in CLAM 40.50.70.6.

For student accounts a single Item Type exists for write-offs (800000007500), excluding CARES related activity. The Item Type is configured to use Pick Up Receivable from Charge (PURC) with the allowance and write-off account distributed to the tuition charge chartstring:

This item type is configured:

- Dr – 790-285-98009 1010110 Allow-Uncollect AR ST

- Cr - 790-285-98009 1011199 Student Accounts Write-Off Error

When the Item Type is applied to the student account, the allowance account (1010110) is debited for the entire amount using 790-285-98009 and the various receivable accounts are credited using the chartstring of the original charge.

Write-Off with Eligible Receivable Account

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| Write-Off | 1 | Write-Off | 1010110 | $1388.66 | 790 | 285 | 98009 | ||

| 800000007500 | Tuition Rec | 1010110 | $(878.34) | 149 | 509 | ddddd | |||

| Inst Fin Aid Rec | 1010110 | $(41.70) | 860 | 279 | ddddd | ||||

| Innov Rec | 1010110 | $(28.18) | 561 | Z61 | 288 | ddddd | |||

| Building | 1010110 | $(124.87) | 060 | Z60 | 289 | ddddd | |||

| Student Fees | 1011020 | $(84.50) | 148 | 508 | ddddd | ||||

| S&A | 1010110 | $(118.21) | 522 | 264 | ddddd | ||||

| Student Self Assessed Fees | 1011020 | $(57.50) | 522 | 264 | ddddd | ||||

| Student Parking Fee | 1011020 | $(30.00) | 528 | 252 | ddddd | ||||

| Student Fee Bookstore | 1010060 | $(25.36) | 524 | 261 | ddddd |

Since this entry would result in debits and credits unbalanced at the fund level, the fund balancing CEMLI reverses the allowance entry in Step 1 and applies the allowance to each chartstring from the original chartstring.

Fund Balancing (CEMLI E-214)

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 2 | Tuition Rec | 1010110 | $878.34 | 149 | 509 | ddddd | ||

| Inst Fin Aid Rec | 1010110 | $41.70 | 860 | 279 | ddddd | ||||

| Innov Rec | 1010110 | $28.18 | 561 | Z61 | 288 | ddddd | |||

| Building | 1010110 | $124.87 | 060 | Z60 | 289 | ddddd | |||

| Student Fees | 1010110 | $84.50 | 148 | 508 | ddddd | ||||

| S&A | 1010110 | $118.21 | 522 | 264 | ddddd | ||||

| Student Self Assessed Fees | 1010110 | $57.50 | 522 | 264 | ddddd | ||||

| Student Parking Fee | 1010110 | $30.00 | 528 | 252 | ddddd | ||||

| Student Fee Bookstore | 1010110 | $25.36 | 524 | 261 | ddddd | ||||

| Write-Off | 1010130 | $(1388.66) | 790 | 285 | 98009 |

In the event an eligible write-off account does not exist, the item type will use the 1011199 Student Write-Off Error account as the credit. When an eligible account is added to the student account, the Write-Off Error account will be reversed, and the eligible receivable account will be credited (as demonstrated above).

Write-Off without Eligible Receivable Account

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| Write-Off | 1 | Write-Off | 1010110 | $1,388.66 | 790 | 285 | 98009 | ||

| 800000007500 | 1 | Error | 1011199 | $(1,388.66) | 790 | 285 | 98009 | ||

| CEMLI E-214 | 2 | Fund Bal | 1010110 | $1,388.66 | 790 | 285 | 98009 | ||

| 2 | Fund Bal | 1010110 | $(1,388.66) | 790 | 285 | 98009 |

Some students might receive benefits through a third-party like Labor and Industries or Veteran Affairs.

Moving tuition charges to a third-party (TPC) is a 2-step process in which all the charges (operating, building, S&A and fees) are ‘paid off’ and a new single payment plan charge is applied to the third party.

- Original tuition charges.

- Pay off original charges with payment plan item type (620000xxxxxx) using internal cash (1000199). This clears the student account of all charges eligible to be paid by Third Party Contract.

- Cash payment fund balanced to original receivable chartstring.

- Third-Party Account charges applied (32000xxxxxxx) to the external organization account (third party) with a receivable (1011xxx) and internal cash (1000199).

- Payment made by the third party relieving receivable. If the third party denies any charges, the receivables are cleared and the charges returned to the student account.

- Cash payment is fund balanced to receivable chartstring.

Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Charge | 1 | Receivable | 1011010 | $93.50 | 149 | 509 | ddddd | |||

| 1xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.50 | 860 | 279 | ddddd | |||

| 2xxxxxxxxxxx | 1 | Receivable | 1011010 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 3xxxxxxxxxxx | 1 | Revenue | 4000020 | $(93.50) | 149 | 509 | ddddd | |||

| 1 | Revenue | 4000020 | (3.50) | 860 | 279 | ddddd | ||||

| 1 | Revenue | 4000020 | (3.00) | 561 | Z61 | 288 | ddddd |

Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment | 2 | Int Cash | 1000199 | $100.00 | 790 | 285 | 98009 | |||

| Item type = | 2 | Receivable | 1011010 | $(93.50) | 149 | 509 | ddddd | |||

| 620000xxxxxx | 2 | Receivable | 1011010 | (3.50) | 860 | 279 | ddddd | |||

| 2 | Receivable | 1011010 | (3.00) | 561 | Z61 | 288 | ddddd |

CEMLI E-214 Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 3 | Fund Bal | 1000199 | $93.50 | 149 | 509 | ddddd | |||

| Line no = | 3 | Fund Bal | 1000199 | 3.50 | 860 | 279 | ddddd | |||

| “10nnnnn” | 3 | Fund Bal | 1000199 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| Eg:”1037385” | 3 | Fund Bal | 1000199 | $(100.00) | 790 | 285 | 98009 |

TPC Charge

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| TPC Charge | 4 | Receivable | 1011100 | $100.00 | 849 | 272 | ddddd | |||

| 320000xxxxxx | 4 | Int Cash | 1000199 | $(100.00) | 849 | 272 | ddddd |

TPC Payment

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| TPC Pmt | 5 | Pmt-Cash | 1000070 | $100.00 | 790 | 285 | 98009 | |||

| 7000000xxxxx | 5 | Receivable | 1011100 | $(100.00) | 849 | 272 | ddddd |

CEMLI E-214 Cash Fund Balancing

| Event | Step | Action | Account | Account 2 | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 6 | Bal Fund | 1000070 | $100.00 | 849 | 272 | ddddd | |||

| See above | 6 | Bal Fund | 1000070 | $(100.00) | 790 | 285 | 98009 |

50.30.60.9.a Third-Party Payments

Some students might receive benefits through a third party like Labor & Industries or Veteran Affairs.

Moving tuition charges to a third party (TPC) is a 2-step process in which all the charges (operating, building, S&A and fees) are ‘paid off’ and a new single payment plan charge is applied to the third party.

- Original tuition charges.

- Pay off original charges with payment plan item type (620000xxxxxx) using internal cash (1000199). This clears the student account of all charges eligible to be paid by Third Party Contract.

- Cash payment fund balanced to original receivable chartstring.

- Third-Party Account charges applied (32000xxxxxxx) to the external organization account (third party) with a receivable (1011xxx) and internal cash (1000199).

- Payment made by the third party relieving receivable. If the third party denies any charges, the receivables are cleared and the charges returned to the student account.

- Cash payment is fund balanced to receivable chartstring.

50.30.60.9.b Accounting for Third-Party Write-Offs

Although write-offs of bad debt for Third-Party Contractors are rare, one Item Type exists for write-offs. The Item Type is configured to use Pick Up Receivable from Charge (PURC) with the allowance and write-off account distributed to the Third-Party charge chartstring:

Write-off for Third-Party Contracts

This Item Type is configured to:

- Dr – 1010130 Allow - Uncollectable Other ST

- Cr - 1011199 Write-Off Error

In the event an eligible write-off account does not exist, the item type will use the 1011199 Write-Off Error account as the credit. When an eligible account is added to the Third-Party account, the Write-Off Error account will be reversed and the eligible receivable account will be credited.

Write-Off with Eligible Receivable Account

Write-Off

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| Write-Off | 1 | Write-Off | 1010110 | $100.00 | 790 | 285 | ddddd | ||

| 8xxxxxxxxxxx | 1 | Receivable | 1011090 | $(93.50) | 149 | 509 | ddddd | ||

| 1 | Receivable | 1011090 | (3.50) | 860 | 279 | ddddd | |||

| 1 | Receivable | 1011090 | (3.00) | 561 | Z61 | 288 | ddddd |

CEMLI E-214

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 2 | Fund Bal | 1010110 | $93.50 | 149 | 509 | ddddd | ||

| 2 | Fund Bal | 1010110 | 3.50 | 860 | 279 | ddddd | |||

| 2 | Fund Bal | 1010110 | 3.00 | 561 | Z61 | 288 | ddddd | ||

| 2 | Fund Bal | 1010110 | $(100.00) | 790 | 285 | ddddd |

Write-Off without Eligible Receivable Account

Write-Off

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| Write-Off | 1 | Write-Off | 1010110 | $100.00 | 790 | 285 | ddddd | ||

| 8xxxxxxxxxxx | 1 | Error | 1011199 | $(100.00) | 790 | 285 | ddddd |

CEMLI E-214

| Event | Step | Action | Account | Dr | Cr | Chartstring Fund | Chartstring AI | Chartstring Class | Chartstring Dept |

|---|---|---|---|---|---|---|---|---|---|

| CEMLI E-214 | 2 | Fund Bal | 1010110 | $100.00 | 790 | 285 | ddddd | ||

| 2 | Fund Bal | 1010110 | $(100.00) | 790 | 285 | ddddd |

50.20 Student Financials Item Types << 50.30 >> 50.40 Student Financials Accounts