ctcLink Accounting Manual | 40.40.30.2 Capitalization Thresholds

40.40.30.2 Capitalization Thresholds

Capital assets thresholds are defined by OFM and eight thresholds are globally configured in ctcLink currently.

| SetID | Threshold ID | Currency Code | Description |

|---|---|---|---|

| WACTC | CT-001 | USD | Standard Cap Threshold |

| WACTC | CT-100K | USD | Bldgs-Infrast-Compnts-Imprvmts |

| WACTC | CT-1MIL | USD | Major Intangibles/IT Software |

| WACTC | CT-1USD | USD | Cap all for Land-Hwys-DOT-CWIP |

| WACTC | CT-COLL | USD | Collections and Intangibles |

| WACTC | CT001 | USD | Capitalization on Unit Cost |

| WACTC | CT1K-5K | USD | Small & Attractive - 1K to 10K |

| WACTC | CT3H-5K | USD | Small & Attractive - 3H to 10K |

With appropriate permissions to the AM Asset Class list users can review the entire list by navigating to Navigator > Set Up Financials/Supply Chain > Product Related > Asset Management > Financials > Capitalization Thresholds.

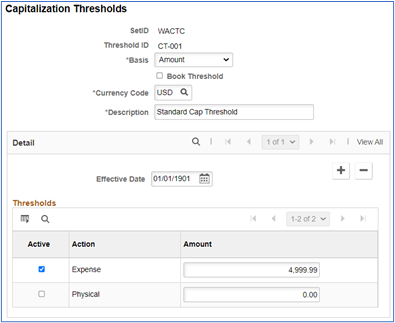

CT-001 Standard Cap Threshold

The standard configuration is set to expense all assets costing less than $10,000. Any asset with a purchase price of $9,999,99 or less will be excluded from asset generation. Assets with a purchase price of greater the Expense amount will be capitalized.

OFM increased this capitalization threshold from $5,000 to $10,000 for all assets acquired on or after October 1, 2024. This change is in response to the increase in the capitalization threshold in the Federal Uniform Guidance.

If the Physical threshold was active, and the asset cost falls within the defined limits, an asset ID would be created but not capitalized.

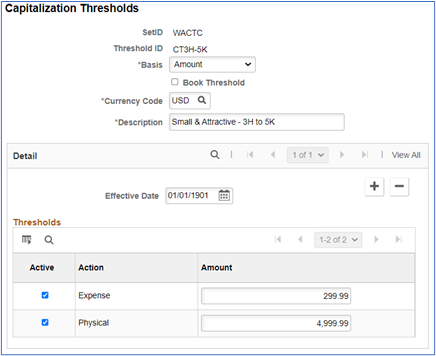

CT3H-5K Small & Attractive - 3H to 5K

This threshold is configured with assets costing less than $300.00 to be expensed. Small and Attractive assets purchased between $300.00 and $9,999.99 to be booked as an asset in Asset Management and assigned an asset ID for tracking purposes.

40.40.30.1 Capital Asset Categories << 40.40.30.2 >> 40.40.30.3 Capital Asset Classes