ctcLink Accounting Manual | 40.10.10 Intra-Agency Transactions (within a college)

40.10 Intra-Agency Transactions (within a college)

Intra-agency transactions may be either reciprocal or non-reciprocal.

Reciprocal Inter-fund

Reciprocal Inter-fund activity is the internal counterpart to exchange and exchange-like transactions (each operating unit/fund/department receives and sacrifices something of approximate equal value). It includes Inter-fund loans, and inter-fund services provided and used.

Nonreciprocal Inter-fund

Nonreciprocal Inter-fund activity is non-exchange in nature (each operating unit/fund/department receives something of value without directly giving value in exchange). It includes inter-fund transfers and reimbursements

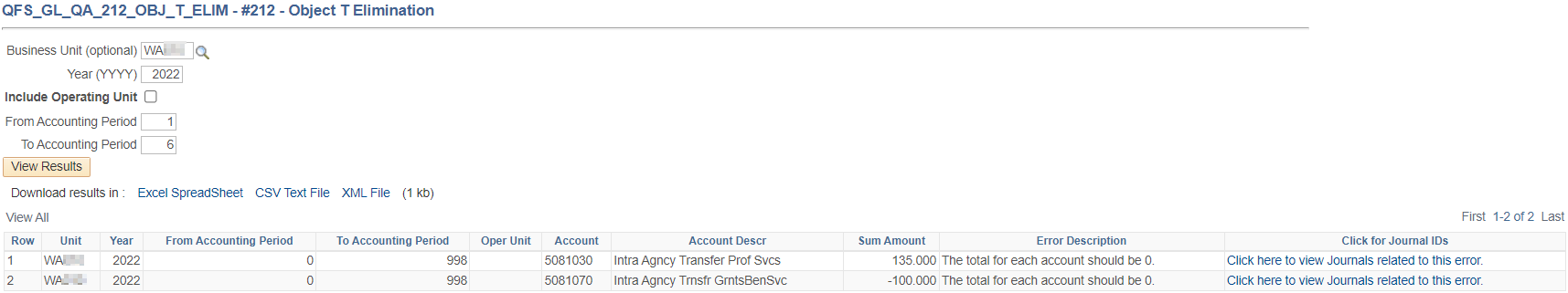

All transfer accounts used must net to zero for each college district by the end of the fiscal year. To aid colleges in complying with this, the SMARTER query will display all variances. The report includes a hyperlink to the journal that caused the out-of-balance.

Figure 1 Query QFS_GL_QA_212_OBJ_T_ELIM

Operating transfers are legally authorized routine transfers from one fund or department receiving revenue to another fund or department that will expend the resources. To be legally authorized, the district board of trustees or its authorized designee must approve operating transfers.

The process for authorizing can include adopted budgets, specific action authorizing a transfer or board adoption of a resolution delegating authority for decisions concerning operating transfers to a designee such as the college president.

Operating transfers between funds are allowed in all non-treasury (local) funds except Funds 149, 790, 840, 841, 997 and 999 and NOT allowed in any state funds.

Operating transfers between 149 and other local funds is not permitted.

When the colleges obtained legislative authority to retain tuition locally, it was with the provision that the funds would be used solely for state supported instructional programs and their administration.

This same limitation applies to the interest earnings on amounts retained in fund 149 (an exception was made for CARES Act funds since federally funding was provided to replace lost tuition).

Operating transfers require the use of a ‘revenue’ account, internal cash account and the subsidiary chartfield.

Each transaction requires a reciprocal/offsetting transaction in the other fund. Revenue and internal cash must net to zero for the transactions.

Illustrative Entries

Inter-fund Transfer Out

| Fund | Class | Dept | Method | Subsid | Acct DR | Acct CR |

|---|---|---|---|---|---|---|

|

146 |

1cc |

ddddd |

Journal Entry |

570000 |

4030150 |

1000199 |

Inter-fund Transfer In

| Fund | Class | Dept | Method | Subsid | Acct DR | Acct CR |

|---|---|---|---|---|---|---|

|

570 |

265 |

ddddd |

Journal Entry |

146000 |

1000199 |

4030140 |

Funding a local capital project in Fund 147 uses the same transaction.

Illustrative Entries

Inter-fund Transfer Out

| Fund | Class | Dept | Method | Subsid | Acct DR | Acct CR |

|---|---|---|---|---|---|---|

|

148 |

1cc |

ddddd |

Journal Entry |

147000 |

4030150 |

1000199 |

Inter-fund Transfer In

| Fund | Class | Dept | Method | Subsid | Acct DR | Acct CR |

|---|---|---|---|---|---|---|

|

147 |

901 |

ddddd |

Journal Entry |

148000 |

1000199 |

4030140 |

40 Accounting Processes << 40.10.20 >> 40.10.30 Inter-Fund Equity Balance Transfer